As we enter 2025, the music and media industries are evolving faster than ever. Last year, we gathered insights from leading experts to predict the biggest trends of 2024, and this year we’re doing it again! This time, we’re dividing into major shifts that define 2024 and what’s on the horizon for 2025.

This year has been full of game-changing developments, from the ongoing growth of AI to significant industry deals and financial shifts. To spare you the deep dive, we’ve compiled the key insights, expert analyses, and market forecasts into this essential summary.

Music: The Year in Review & What’s Next

Let’s begin with streaming—a segment that experienced significant changes in 2024. Luminate’s 2024 Year-End Music Report reveals that while On-Demand Audio (ODA) streaming maintained global growth, the most notable trend was its rapid expansion outside the U.S. While streaming in the U.S. increased by 6.4%, international markets saw a much stronger surge with a 17.3% growth rate.

This expanding global footprint was reflected in financials as well. Music Business Worldwide reported that Spotify paid out a record-breaking $10 billion to the music industry in 2024, surpassing 2023’s total by $1 billion. Key emerging markets like India, Brazil, Mexico, and Nigeria played a significant role in this surge, highlighting the shifting dynamics of paid music consumption.

Spotify’s VP of Music Business, David Kaefer, captured this shift perfectly: “A decade ago, there was a widely held view that you couldn’t monetize certain markets. But the journey of getting the world to pay for music means making long-term investments.”

What does this mean for 2025? Expect even greater focus on global expansion, diversified monetization strategies, and AI-driven personalization in streaming. Stay tuned as we continue unpacking the biggest insights shaping the future of music and media!

The Future of Streaming Deals & Artist Payouts

As noted by Forbes, “music streaming services account for 89% of the total music industry revenue, underscoring how streaming has transformed the distribution, access, and monetization of music.” However, with this increase in revenue, the discussion about fairer compensation for artists and songwriters has also gained momentum.

“Music streaming services make up 89% of the total music industry revenue”

Forbes

With UMG and Spotify starting 2025 with a major licensing deal, the industry is paying close attention. Could this mark the beginning of a series of new agreements designed to transform artist compensation models? As streaming platforms vie for market leadership, we might see more strategic partnerships between major labels and services that impact royalty structures, artist payouts, and the broader economics of the industry.

One thing is certain, the conversation around equitable streaming revenue isn’t going away anytime soon. Stay tuned as we continue unpacking the biggest insights shaping the future of music and media!

Superfans & The Future of Music Monetization

As streaming revenue hits a saturation point, the industry is focusing on superfans as a new opportunity for monetization.

Music X authors Maarten and Rufy Ghazi explain, “Right now, it mostly feels like squeezing more money out of fans. But when done right, the direct-to-fan connection can bring the fans what they want for the value they place on that experience.”

This aligns with insights from MIDiA’s Olivia Jones, who explains, “Superfans may not be the only solution to stagnating subscription revenue, but nurturing fandom and investing in expanded rights can help offset it.”

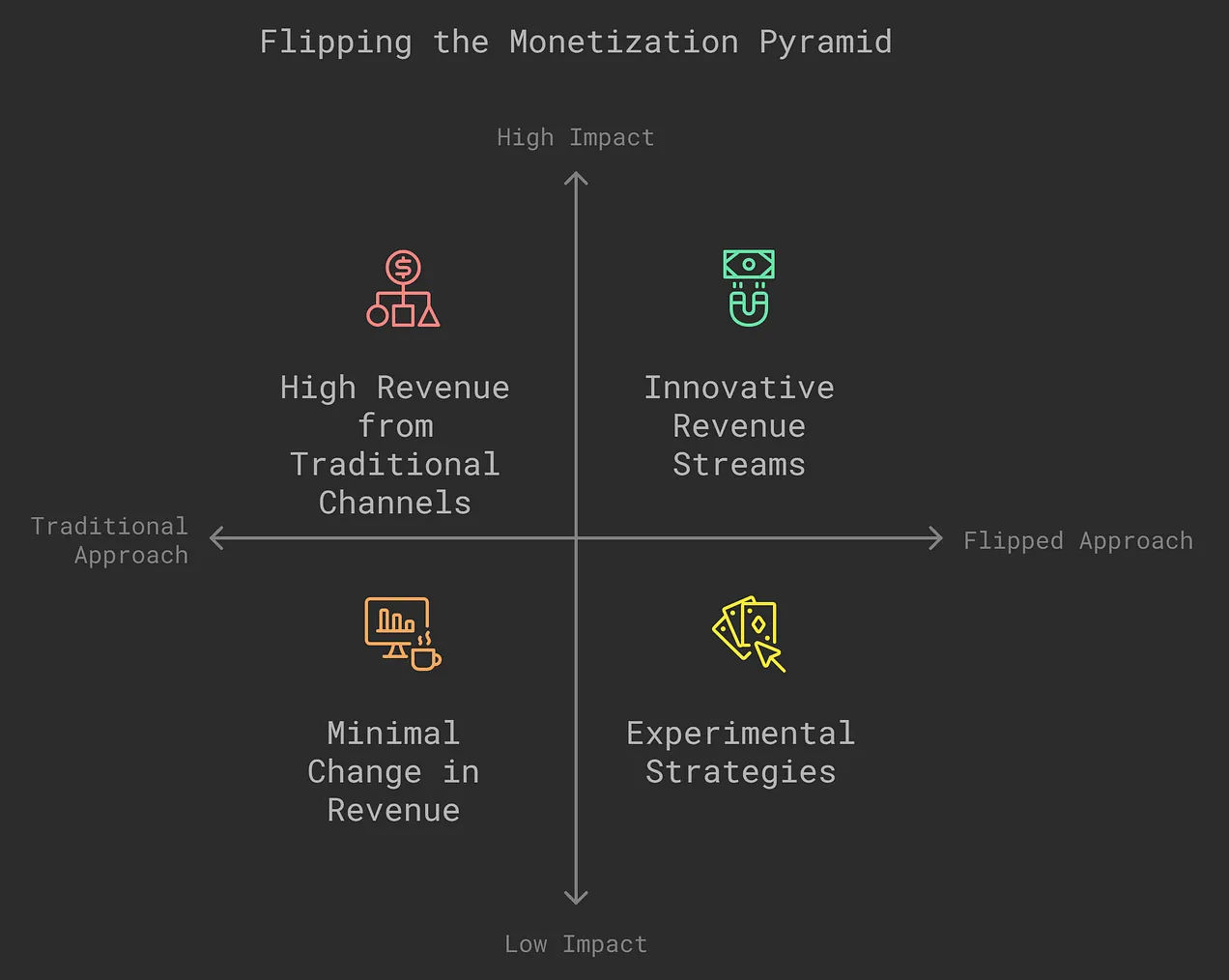

What’s on the horizon? A fresh approach to the music monetization model. As Music X describes,“the fact that monetization remains the point of innovation allows us to rethink the monetization pyramid. Figure out how money can flow through that pyramid when it’s flipped on its head.”

Could this be the formula to reshaping artist revenue models in 2025? If labels, streaming platforms, and artists can effectively harness direct-to-fan engagement, we might witness a fundamental change in how music is valued and compensated. Keep an eye out as we monitor these shifts!

Sync, The Rest Is Still Unwritten

In late 2024 Synchtank spoke to Tim Miles, SVP Global Sync at Warner Music to reflect on the year and discuss what 2025 holds for sync licensing. Overall, Miles explained that it was a good year for sync but explained that the landscape has changed with developments in new parts of the world, particularly in Asia and EMEA due to the strikes we saw in the U.S.

One stand out point was the rise of “shallow catalogs” particularly from the 90s and early 2000s – the big hits in those years are being seen as more appealing for licensing opportunities. Perhaps we’ll see a continued growth of those catalogs in 2025, so one to watch on the sync front.

Looking ahead now, Miles is optimistic about the year ahead, saying “2025 promises to be an exciting year. I think we’ll see a resurgence in Hollywood with a return to the golden age of production. There’s renewed energy in the market, and content from around the world.”

“We’ll see a resurgence in Hollywood with a return to the golden age of production. There’s renewed energy in the market, and content from around the world.”

Tim Miles, Warner Music

In terms of sync opportunities for this year Miles explained that “the way music is used in films and TV has evolved, with music becoming more of a character than just a background element.” As the industry continues to embrace the digital age that we are in, we will see the spectrum of sync opportunities continue to grow.

AI In Music & Media: Bias vs Creativity

An insightful article by Gareth Deakin on the bias in AI and creativity sparked a need to include it in our year-in-review. It provides valuable food for thought on the ongoing debate about AI, particularly the tension between fully embracing it and outright rejecting it.

Deakin explains “how these new [AI] tools will interact with the many ways humans create and experience meaning together and what kind of systems we build for the artists that create and the music fans that appreciate them is the challenge ahead of us. Understanding the source of our biases and different contexts doesn’t resolve the debate about AI in creative fields, but perhaps it helps us have a more nuanced conversation.”

Understanding the source of our biases and different contexts doesn’t resolve the debate about AI in creative fields, but perhaps it helps us have a more nuanced conversation.”

Gareth Deakin

Synchtank has said and advocated that AI should act as a tool, not replace human creativity. Which is exactly what we do, allowing our customers to focus on the music without replacing what they do with AI, but enough of us…what is predicted for AI in 2025?

Peter Csathy shared his 10 Predictions for AI, Media & Entertainment in 2025, so let’s take a look at some of the key ones. The most notable is the federal district courts making their first “Fair Use” ruling. While this won’t fully resolve the “fair use” debate, as not all courts will align and generative AI companies may appeal, initial wins for IP rights-holders will have significant, far-reaching consequences. Csathy also predicts that “Ethical AI” will gain traction, driven by these court cases, and will become a major theme in 2025.

Returning to the point of using AI as a tool, Csathy forecasts that the entertainment industry will need new AI tracking, reporting, and payment systems to monitor content usage. Building on this, he suggests that 2025 will be a pivotal year where entertainment companies will begin to reach agreements with individual talent (and their guilds) on how GenAI should be implemented.

Overall, there’s still much progress to be made with AI, and we wouldn’t be surprised if more legal challenges emerge in the coming years.

From Music to Media

This year Synchtank delved into the challenges faced in the media sector, particularly those working with music to identify their pain points and concerns surrounding their day-to-day lives. Unsurprisingly AI and job security were at the top of the list! However, despite the layoffs and economic pressures we saw last year, there’s hope for continued demand for music in TV and film productions. More notably, the creative reins at larger companies are being handed back to individual creators, signaling a move toward more inclusive and diverse creative practices.

Movies, The Silver Screen

When we take a look towards the big screen of film and cinema, Bloomberg’s Lucas Shaw reported that last year nine of the 10 highest-grossing movies in 2024 were sequels, reboots or prequels. This unsurprising led to the prediction of zero original movies featuring in the top 10 in 2025.

Nevertheless Shaw says “the movie business will bounce back” with a “predicted resurgence in independent film outside of the US and a revival in independent TV production.”

“A resurgence in independent film outside of the US and a revival in independent TV production.”

Lucas Shaw, Bloomberg

TV vs Streaming

With big deals and money moves hitting the news last year for broadcasters could we see more of that this year?

Lucas Shaw covered “the rapid decline of the conventional pay-TV business is forcing many companies to make major changes. Comcast is spinning off its cable networks. Warner Bros. Discovery is reorganizing around streaming and studios. Paramount explored selling a couple networks, and then its owners sold the whole company.” The above is no surprise why Shaw is predicting that media companies will combine streaming services and sell cable networks.

From Nielsen’s analytics here we can see that streaming growth from Netflix and Amazon is having an effect on broadcast television and now the streaming providers are moving into gaming and sports, we only have a question of what will that do to the industry as a whole?

And before we move onto gaming, rumours have surged surrounding Netflix who will apparently enter the music streaming industry very soon?! But we’re not sure how true that is or where the rumour has come from so no more on that topic…for now.

Gaming’s Continued Enhances

An industry seeing a lot of news this year is the games market, and with most of the entertainment world, subscriptions seem to be dominating. MIDiA found that “subscriptions will not be the main method of game distribution” and users don’t seem to be changing their behaviour on this, meaning 2025 will keep subscriptions as a secondary revenue stream.

Another area MIDiA revealed is that advertising will become more prominent at the platform level, although this has seen challenges in the past, MIDiA says “the games market and advertisers alike need new revenue streams.”

“More developers will publicly decry generative AI and will mobilize fans of their games to do the same.”

MIDiA

It also wouldn’t be a 2025 prediction post without a nod to AI, and although generative AI is relatively new in gaming, MIDiA says“more developers will publicly decry generative AI and will mobilize fans of their games to do the same.” So, AI isn’t necessarily coming to gaming but these organizations will hold a stance against generative AI.

We should also acknowledge the connection between gaming and music as mentioned in the Music X article by Maarten, where he highlights the important factor that music plays within games. We know different gaming companies have different methods. Some will have music composed specifically for them, allowing them to build their own library of owned assets, and others will elect to work with outside libraries, labels and publishers. Both come with their own set of challenges however with streamlined collaboration to the music industry will only benefit both parties.

Perhaps 2025 can see more collaborations between these two industries?

Sports, In A League Of Its Own

One industry we can’t ignore is the global sports rights market and the massive moves that have taken place between rightsholders and streaming platforms, as the likes of Netflix attracted 24 million viewersto the first Christmas NFL games.

From what we saw in 2024, we know that these deals have a huge impact on the industry’s growth. According to the Ampere Analysis Report “Globally, 2024 saw streaming services surpass the $10bn mark in spend on sports rights – up from $2.8bn a mere 5 years ago.”

This growth is not expected to slow down either, with Ampere expecting streaming platforms’ spend on sports rights to exceed $11bn accounting for 23% of the global sports rights market.

Streaming platforms’ spend on sports rights to exceed $11bn accounting for 23% of the global sports rights market.

Ampere Analysis

Nevertheless, the report outlines the potential issue for fans who enjoy a range of leagues and sports as they may have to spend more on multiple subscriptions to the OTT services. Which begs the questions, will that have a negative impact on this sub-sector and will streaming platforms surpass TV networks?

Wrap Up

There is a lot going on across the whole of the entertainment industry but as we continue to grow and learn in this digital age it’s hard to know exactly what the future holds, but isn’t that exciting?!

What do you predict will happen for both music and media in 2025? Share your comments and thoughts with us!

Don’t forget to subscribe to our newsletterfor more top stories and weekly analysis.

And lastly, you may not know but we are more than just a blog! Synchtank provides cutting-edge software to simplify and streamline music catalogs – from sync to productions for publishers, labels, libraries and broadcasters alike.

For more information on this check out our asset rights management software today.

1 comment

It used to be standard practice for visual media production companies to use production music libraries for their productions. This was in order to have quick access to an underscore and also to avoid any possible legal issues down the road, as the music would be licensed in a safe way. It would also keep sync costs down as most of them would have a blanket licensing scheme.

Today, the library music licensing system, seems to be having more of a tough time due to so much competition from the many ways that visual media can now grab some music.

Of course, the mega-production music libraries like Time-Warner are still doing ok, due to their huge footprint in the industry. But the smaller independent ones are definitely suffering and it’s possible that with the growth of AI generated music, things will definitely be more difficult. However, as a composer and owner of a small, independent music library, I am keeping faith that due to the complexities of organic, human creativity in all the arts, it will still be a while before AI music generation, will take over totally.