Luxembourg-based ANote Music, the European marketplace for investing in music royalties, has today officially launched its investment platform.

We caught up with co-founder Marzio Schena to learn more about the platform that aims to “make music royalties globally accessible to all in a marketplace that bridges the gap between the music industry and capital markets.”

What’s your professional background and how did it lead to you launching ANote Music?

I founded ANote Music, the European marketplace for investing in music royalties, in 2018, along with my co-founders Grégoire Mathonet, CTO, and Matteo Cernuschi, COO. I myself am CEO of the company. Prior to co-founding ANote Music in 2018, I was a fund manager at Woodpecker Capital, specialising in global equities and derivatives. I am also currently a member of the Global Shapers Luxembourg Hub, a community of entrepreneurs formed by the World Economic Forum to drive dialogue, action, and change. In addition to this, I have 5 years of experience in the event management industry in Milan, Italy.

The “aha-moment” for ANote Music came when Matteo and I were watching the music festival ‘Sanremo’ and said to ourselves how amazing it would be to invest in music from those artists.

Based on my experience, I have always enjoyed discovering new industries and thinking about how technology can solve real world problems. The “aha-moment” for ANote Music came when Matteo and I were watching the music festival ‘Sanremo’ and said to ourselves how amazing it would be to invest in music from those artists. After doing the necessary market research and digging deeper into the music industry, we quickly realized that music has many similarities with standard stocks, and instead of generating dividends it generates a cash flow through music royalties. Shortly after, we were introduced to Gregoire, who eventually became the third co-founder of ANote Music. Together, we established a solid business plan and started working on the initial stage of the trading platform.

Can you explain how the platform works for both investors and artists/labels/publishers?

On one side, our platform allows music rights holders (such as artists, labels, publishers,…) to offer a percentage of their rights up for auction to a wide network of retail investors and music fans. The biggest part of the onboarding process happens offline between our development team, industry experts/advisors and the seller. In the first phase, before we publish anything on our platform, a complete due diligence process is done for the assets by our team. Once both the seller and our team have agreed upon the valuation of the music catalogue and selling terms, ANote Music advances to publish the catalogue on the platform and promotes the investment opportunity. From there on, an auction is launched with the Dutch Auction Principle. As soon as the auction has successfully been completed, the collected money gets transferred to the seller.

The platform gives fans and investors the chance to invest in an alternative and diversified asset class: music.

On the other side, the platform gives fans and investors the chance to invest in an alternative and diversified asset class: music. Registering for our platform is free and all users get access to every music catalogue that ANote Music has up for auction in our primary market. Users can analyse the financial history and background information for each music catalogue, and if they decide to, place bids to participate in the auction. When a bid is successful and the auction is completed, shares get distributed accordingly to the user’s portfolio. Each time royalties are being paid out, ANote Music makes sure to collect and distribute the rightful amounts to all the investors pro-rata. The users can also trade music rights with other users on our secondary market and will establish these trades on an offer-and-demand principle.

What differentiates you from other players in the market?

ANote Music is focused on a financial approach and wants to make sure that all assets on the platform are realistic investment opportunities. That is a big differentiator already, compared to some other players in the market who have a bigger focus on crowdfunding solutions. We have been targeting retail investors and music fans alike, lowering the barrier to investment opportunities for a long time now. This has always been a central priority for us. Our secondary market, allowing users to easily trade (commission free) between each other, stands out. Last but not least, our platform is built with blockchain technology integrated, which is adding an extra layer of traceability and transparency for the users to our platform.

ANote Music is focused on a financial approach and wants to make sure that all assets on the platform are realistic investment opportunities.

What makes music royalties an attractive asset class?

First of all, music rights are a diversified alternative asset class. This means that there is little to no correlation to the financial markets, which nowadays experiences big fluctuations. Music rights have a more stable profile and the trends are easier to predict and follow.

Generally speaking, investments in music royalties return between 6 and 17% annually, which make them interesting assets to invest in. Also, we are speaking about an industry that is experiencing a nice growth, thanks to the ever expanding streaming services. Goldman Sachs for example is predicting total streaming revenues to reach approximately 37.2bn dollar by 2030 from 1.15bn paying users worldwide.

But let’s forget for a moment about all the financial perks that investing in music brings along. On an emotional level, music rights also become a very attractive asset class. The satisfaction of owning a percentage of the shares to your favorite music makes listening to it even better. You will not only be listening to your favorite music, but you’ll be earning money while doing so. Cool, isn’t it?

What does ANote Music offer to music rights holders and what kinds of catalogues are you looking for?

Firstly, we offer the opportunity to get access to immediate funding. The music industry often has to deal with deferred payments, and for many in the industry it isn’t easy to quickly find financial support for new projects. Our auction system offers a solution to those issues, while at the same time allowing the seller to keep 100% control of their artistic freedom. Having a catalogue published on the ANote Music platform also generates extra visibility, to a different audience who can discover new music. For other rights holders it can be a great way to even better connect with their fanbase.

Every catalogue gets evaluated on a case-by-case basis. We want to bring a wide scope of different opportunities to the users of our platform, so we don’t limit ourselves by pre-selecting a certain type of music catalogues. However, we have some requirements that need to be met. We don’t work with new music — the music catalogues that we look to onboard require a minimum track record of 3 years financial history and steady royalty generation. Currently we are looking for catalogues that have an average earning of €10,000 yearly.

What are the main factors that determine the value of a catalogue?

Music catalogues are valued mainly based on expectations of future performance, i.e. their expected revenue generation in the years to come.

As a rule of thumb, catalogues trade at multiples between 6 and 16 times their historical normalized royalties – with additional factors to be considered for a more precise valuation.

If we take past performance as a proxy for the future one, one can easily determine a pricing multiple that fits his own investment and return criteria. As a rule of thumb, catalogues trade at multiples between 6 and 16 times their historical normalized royalties – with additional factors to be considered for a more precise valuation including the catalogue stability through time, the genre, the artist popularity, exposure to streaming etc.

How are the rights acquired through ANote Music actively managed and exploited?

At ANote Music, we allow the right holders only to sell up to 50% of their shares. This makes sure that our objectives remain aligned. The acquired rights don’t need active management as this task remains in the hands of the seller, so we speak about a passive asset class. Being part of our extensive due diligence process, we make sure that the management of the rights remains in the hands of those experts who know best how to exploit them.

Can you talk us through the role that technology plays in the ANote Music platform, and how you are managing the distribution of royalties?

Being a tech company, you can imagine that technology plays a very important role in our story. We’ve created our entire platform from scratch, everything has been coded with the specific idea to bring a smooth and trustworthy investment platform to the market. While blockchain technology wasn’t a real must for the platform to perfectly function, we opted in for all the perks it offers for our users. We also strongly believe that the integration of blockchain technology will give access to other opportunities in the future, so that we can keep growing and remain relevant with the time.

In terms of royalty distribution, our system simply distributes the royalties, as received, to the investors’ portfolios, pro quota to the number of shares.

The platform is launching with a sale for Italian label IRMA Records. Can you tell us more about that?

The platform is officially launching on July 28th, 2020 and will offer multiple catalogues to invest in. However, as in the lead up towards our launch we have received high interest from many people, we decided to launch a pre-order phase. For this pre-order we partnered with IRMA Records, an Italian based publisher with more than 30 years of experience in the music industry. To be able to pre-launch with a music catalogue from such an established player within the Italian music industry, of course is an incredible boost for us. We are grateful for the support that we have been receiving from IRMA Records since day one. Their music catalogue brings a wide variety of songs, ranging from lounge music, to soundtracks that were used in Sex and the City.

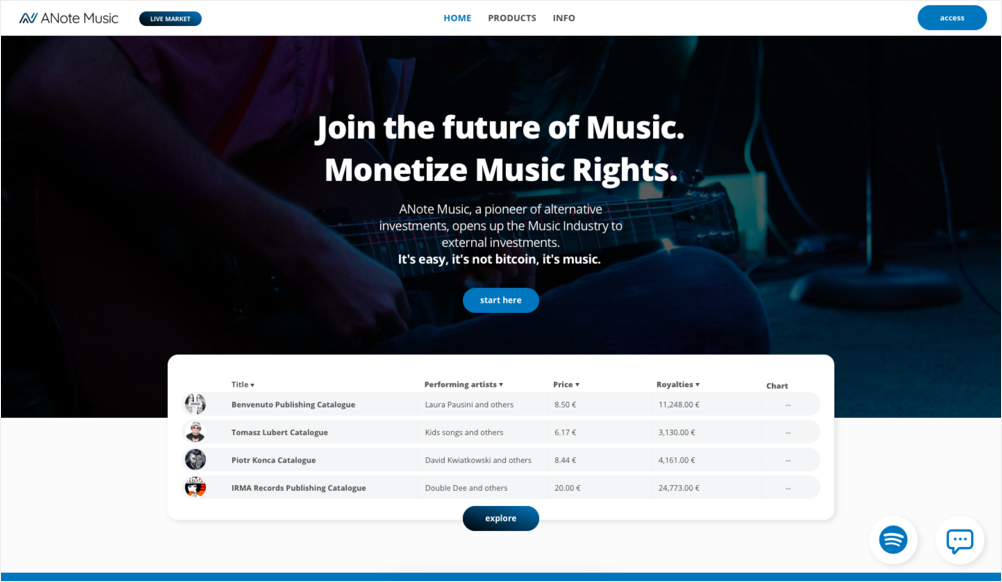

Investors who joined the pre-order could benefit from a 5% cashback discount and will not pay any distribution fees on those rights for the first two years. Let’s call it an early-bird advantage. In addition to the assets listed from Irma Records, new assets come from Italian publisher Benvenuto Edizioni Musicali and renowned Polish artists Tomasz Lubert and Piotr Konca.

The ANote Music team

What, in your opinion, are the most exciting growth areas in the music industry with regards to royalties?

Of course, the expanding streaming services play an important role here. More and more people worldwide are getting access to smartphones and connected devices that can stream music at any time, anywhere. We have seen illegal piracy of music go down and each day more people are shifting to these easy to use, paid services.

Technological improvements also allow for better tracking. There are more and more projects popping up that make it easier to follow when music is being consumed. Just imagine what a fully integrated blockchain technology could do for the music industry. Today, it’s possible that the world is not yet ready for this, but I believe someday this will happen.

Last, but not least, governmental policies are becoming also more favourable for fairer payments and better compensations for creators. We fully support these changes, as we wish to see the music industry thrive to new heights.

What tends to be the biggest barrier when it comes to convincing the financial community of the value of music royalties as alternative investments?

Surprisingly, we haven’t encountered much resistance from the financial community when it comes to investing in music royalties. I believe that the whole movement around cryptocurrencies has opened the path, and that alternative investments are nowadays easier welcomed by the general public thanks to this.

The biggest barrier we have experienced is that the possibility to invest in music is completely new to many. “Fear of the unknown” is something that plays in many people’s minds. At ANote Music we put a high importance on clear communications and providing the necessary information to users to fully understand the financial displayed on our platform. In general, I can honestly say that overall the concept of investing in music rights as alternative investment gets warmly welcomed by the financial community.