Labels and distributors have had Spotify play data for years through the service’s API. Artists and managers have had their own bespoke data feed and dashboard via Spotify for Artists, initially launching as Fan Insights, since the end of 2015. Now publishers and songwriters are finally getting access to rich streaming data around their compositions.

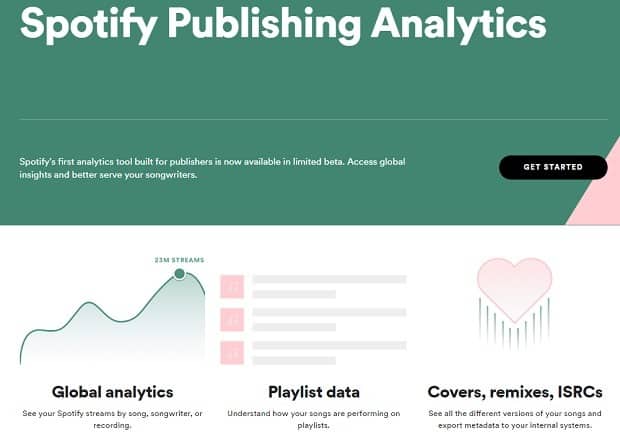

Launching on 8th November, Spotify Publishing Analytics might be in beta initially and a slow onboarding of publishers and writers still has to happen, but its arrival is significant for a number of reasons. It offers daily analytics, giving insights into how songwriters’ works are performing on the streaming platform, including how they are being engaged with on playlists (increasingly the most powerful way to drive streams for both frontline and catalogue releases).

A number of PROs and publishers have been offering analytics to writers but this is a first from an actual streaming service. And, as we have seen again and again with regard to data, where Spotify leads, others will follow; and so something similar on Apple Music (given the launch of Apple Music For Artists earlier this year) and other DSPs could be in the pipeline.

There are three main parts to it at launch, but like all its tools, these will evolve when more people start using it and put in requests for what else they would like it to do. For now, however, there are: 1) global analytics that give insight on streams that can be broken down by song, songwriter or recording; 2) playlist data, which is pretty self-explanatory, showing which songs are performing best on which playlists; and 3) covers/remixes/ISRCs, covering all the different incarnations of a particular composition and allowing publishers to export metadata around them into their own internal data and royalty tracking systems.

Spotify is – of course it is – selling this as a gamechanger and a way to empower writers and publishers by helping them work smarter across key parts of their business, including A&R and licensing/synchronisation. Rather than wait until a collecting society processes payments, writers and publishers can chart in near-real time what is happening to their works. The benefits are obvious in a market that increasingly means everyone has to respond to streaming trends and openings with lightning speed. Any lag in data means a concurrent lag in opportunities.

None of this has happened in a vacuum, of course. Spotify has, at times, had a strained relationship with the publishing community, not least its argument last September, in response to legal action over mechanical royalties, that mechanicals might not even be due on streams in the US.

That landed extremely badly and the streaming service has been working to rebuild bridges in that time. So this can be looked at through the same lens as when it first published its guide rate for microroyalties when recording artists began to complain about the cheques they were receiving. This was done in part to offer transparency but was also done to redirect artist ire towards labels. This, Spotify argued, is what we pay out per stream to labels; if you’re not seeing anything near those rates in your digital statements, take it up with your label and not us.

The arrival of Fan Insights/Spotify for Artists was also another political play by the company, creating bifurcated relationships with labels on one side and artists/managers on the other. By giving artists and managers their own data feeds, it was deftly moving to get them on side and fostering increasingly tight relationships with them so as to not rely on record labels as the go-between.

It comes on the back of adding songwriter and publisher data (where available) to its desktop app in February and the iOS version of its mobile app in August. Admittedly this is buried deep within the app and you really have to know where to look for it. (On the iPhone app you have to tap the “…” to the right of a song title and scroll past various options like “save”, “add to queue”, “view album” and go right to the bottom, just after “report explicit content”, to get to “song credits”.)

This is the context in which Spotify Publishing Analytics have arrived. That is, of course, no bad thing as it is giving writers and publishers considerably greater insight into what is happening with their compositions and at scale.

Cumulatively this all looks like a charm offensive to end any residual tensions with publishers – although how the publisher split of royalties stacks up against that paid to labels will long remain a bone of contention.

Do not expect that to change any time soon. “Right now we’re focused on providing publishers with this valuable data,” Spotify told Music Ally on the launch of Spotify Publishing Analytics. “Spotify Publishing Analytics won’t change anything about how publishing royalties are accounted or paid.”

While this is all encouraging for publishers and writers, there is inevitably a “but”. Or rather there are several “buts”.

There is still a considerable mismatch between recording data and publishing data on all streaming services, meaning royalties can be held for infuriatingly long periods in escrow until the proper rightsholder or rightsholders are identified. This is particularly problematic for covers and anything using samples. The biggest hits – those 500,000 songs that many estimate do the bulk of Spotify’s total plays – are going to be (for the most part) fine; but once you go far down the long tail (for those writers who really do need every microroyalty they can get), that’s where it could get bumpy. It is important to stress this is not just a Spotify issue – every DSP in the world is grappling with this; but that said, it is important to note that Spotify Publishing Analytics might be a great tool for tracks with spotless metadata but it is not going to be a panacea for all.

The day before Spotify pulled the curtain back on Spotify Publishing Analytics, co-founder Daniel Ek said something in an earnings call that could have profound implications for what it has just given to the publishing world.

Asked by a reporter if he had “any plans to charge artists for data or for promoting work on the paid service in any way”, Ek gave this response.

“Our strategy in our marketplace side of the business is the same as we have on the rest of Spotify, which is it’s a freemium business, meaning there will be a certain amount of products which artists and labels can get for free, and there are others which we will charge money for. So, that’s an evolving strategy when it comes to our product portfolio. Data specifically is very unlikely to be one of those things that we’ll charge for.”

This was vague enough to allow it wriggle room in the future but also specific enough to have labels, managers and artists start to swallow deeply. Something they have become hugely reliant on in their marketing and strategic planning could change and they may find themselves paying for it (“very unlikely” is not an outright assurance data tools will be free forever). Or maybe, as with the free version of Spotify itself, they get a limited set of tools and data feeds for free but the very top-tier ones could come at a cost.

Perhaps it was hot air designed to gently but firmly remind labels and managers that Spotify is being altruistic here in letting them access the data they can at the moment but they should not become apathetic about it. It may have no plans to charge at all but a statement like this – with its non-committal nods and allusions – works in its favour to keep those around it on their toes. A slight flexing of its muscles can work as a subtle reminder of the enormity of its power.

Publishers might be rejoicing that they are finally getting access to this data but, as they are slipstreaming labels and managers in terms of data access, it is a foreshadowing of what could be coming down the line and a reminder that only the foolish or the reckless believe that everything lasts forever.

1 comment

[…] Better Data Than Never: Publishers Finally Get Under the Spotify Bonnet — synchtankltd.wpengine.com As Spotify adds Publishing Analytics, Eamonn Forde examines what this might mean for publishers and songwriters. […]