This article was originally published in Creative Industries News by Emmanuel Legrand.

The global music publishing market was worth €7.68 billion in 2021, against €6.51 billion in 2020, with the independent sector accounting for 27.1% of the total, or €2.08bn in 2021, compared with €1.95 billion in 2020, according to figures released by the Independent Music Publishing International Forum (IMPF) during the organisation’s AGM in Stokckholm.

The Independent Music Publishing Global Market View, is the report of this kind published by the IMPF, which represents independent music publishers internationally. The report, penned by Emmanuel Legrand, Editor of Creative Industries News, is sponsored by Musixmatch, the leading music data and lyrics licensing company.

Reservoir’s Annette Barrett

“Independent music publishers are a vital creative force in the modern music business,” said Annette Barrett of Reserv

The value of the independent sector

The estimates are based on figures from the International Confederation of Societies of Authors and Composers (CISAC) and its yearly collections report, trade publication Music & Copyright, and its yearly estimates of the music publishing market, and the report on the value of the music rights market produced yearly by economist Will Page.

The IMPF report provides “in-depth, authoritative insight into the value of the independent music publishing industry and the sector’s influence on the modern music ecosystem,” according to IMPF. The latest report covers the year 2021, which is the latest year for which global music data is available.

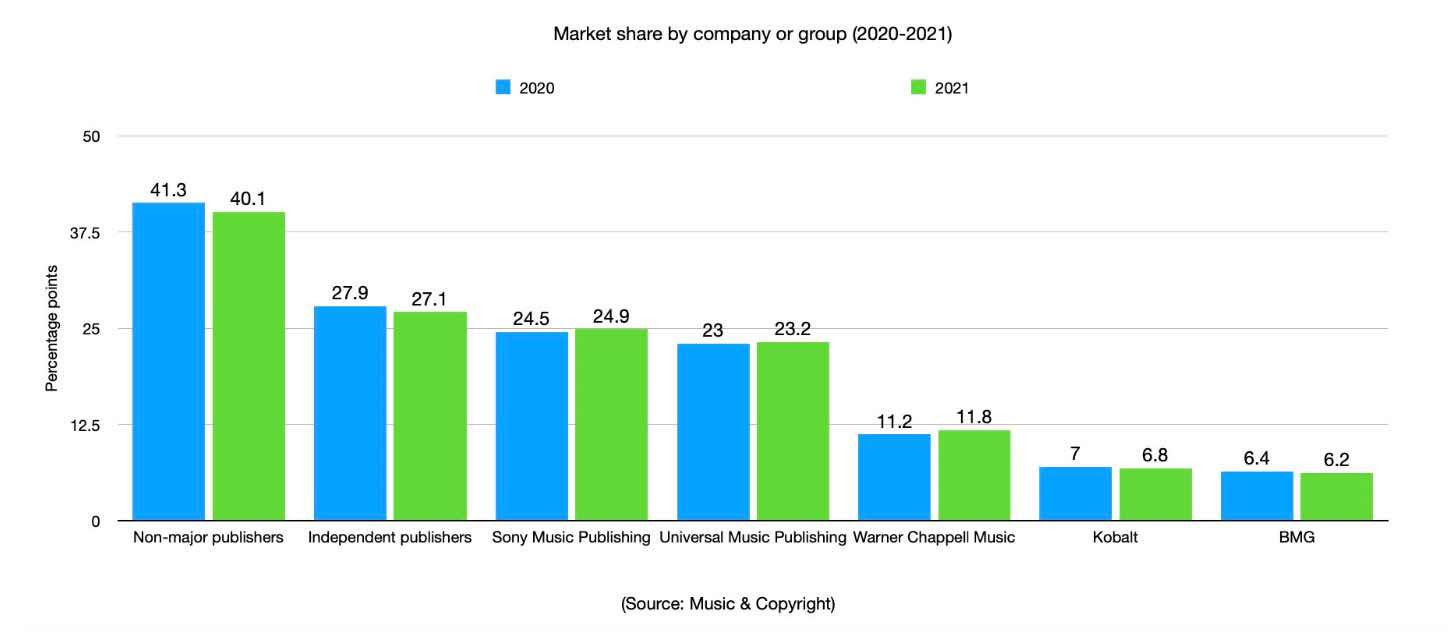

The report paints a picture of the independent music publishing market as it battled and exited the Covid-19 pandemic. Altogether, the major companies — i.e. the music publishing affiliates of major music companies, i.e. Sony Music Publishing, Universal Music Publishing Group and Warner Chappell Music — accounted in 2021 for 59.9% of the global publishing market, according to estimates from Music & Copyright.

The largest collective entity

Of the remaining 40.1%, two companies — Kobalt and BMG — accounted for 6.8% and 6.2% respectively, which would put the independent music publishing sector (defined as companies with a global market share of 5% or below), taken collectively, at 27.1% of the total market.

Such a combined market share would qualify the independent music publishing sector as a collective entity with a market share higher than that of the largest music publisher in the world (Sony Music Publishing).

Will Page

According to studies by the economist Will Page, the global music rights market was worth $39.6bn (€34.05bn) in 2021, with $13.5bn (€11.84bn) generated by the music-publishing sector.

Most revenues coming from CMOs

Within this aggregate of €11.84bn, €8.48bn was channelled through the global network of collective management organisations (CMOs), and reported via CISAC, and $3.44bn directly generated by publishers, mostly though synchronisation rights.

The income going through CMOs is usually split 50-50 between publishers and songwriters. Based on Will Page’s figures, this would equal to €4.24bn for publishers, to which the €3.44bn generated directly by music publishers is added.

In total, the global music publishing market was worth €7.68bn in 2021, against €6.51bn in 2020, based on restated figures.

A multi-billion-dollar industry

Since independent music publishing represents 27.1% of the €7.68 billion total, according to Music & Copyright and estimates from IMPF, and based on Will Page’s figures on the overall value of the music copyright market, IMPF estimated that the independent music publishing market was worth €2.08 billion in 2021, compared with €1.95 billion in 2020.

The share of independent music publishers varies according to the countries. However, there is a lack of market information on music publishing, which makes it difficult to get into the granularity of each country.

Downtown’s Molly Neuman

Commented Molly Neuman, CMO at Downtown Music Holdings: “What this report shows is that music publishing is a multi-billion-dollar industry and independent music publishers play a central role in this economy. In recent years, we’ve seen the rise and expansion of independent music publishers and self-published songwriters and creators, thanks in no small part to digital distribution and the growing global network of digital platforms. This new stream of revenues has brought a whole range of new and exciting opportunities and significant revenues.”

Importance of synch rights

The report highlights the importance of two main stream of revenues for publishers — the one processed through the network of collective management organisations, and the revenues generated directly by publishers, namely synchronisation rights.

Elisa Amouyal, Founder of Talit MuZic Publishing (Israel), commented: “A large part of music publishers’ revenues goes through the network of collective management organisations. They are music publishers’ most important partners. Without them we would not be able to collect all the monies that are owed for the use of music.”

CISAC and its members societies collect mainly from public performances (music played in public, live or by broadcasters), digital (DSPs), mechanical (CDs), among others. Most of these streams of revenues were affected during the Covid pandemic, based on CISAC figures and based on the way royalties are collected and distributed, the effects of Covid will still be felt in 2022, before a full recovery in 2023.

A complex business

“Music publishing is a complex business,” said Jennifer Mitchell, from Red Brick Songs (Canada). “Publishers are at the heart of the creative process, but they also deal with data issues, licensing agreements, royalty collection and distribution, and much more. This report shows the value music publishers, especially independent publishers, bring to the music ecosystem. And our great strength is that we are present in every country where music is created.”

Red Brick Songs’ Jennifer Mitchell

As a testimony to the resilience of the sector, music publishers have continued to sign new songwriters, collect, and distribute royalties, grant synch licenses and build their businesses, while continuing to build international careers through a network of like-minded publishers.

“Independent music publishers, like my company, are very active in our local market, and outside of our country, we rely on a network of sub-publishers who know their local markets,” explained Ichi Asatsuma of Fuj

The diversity of situations

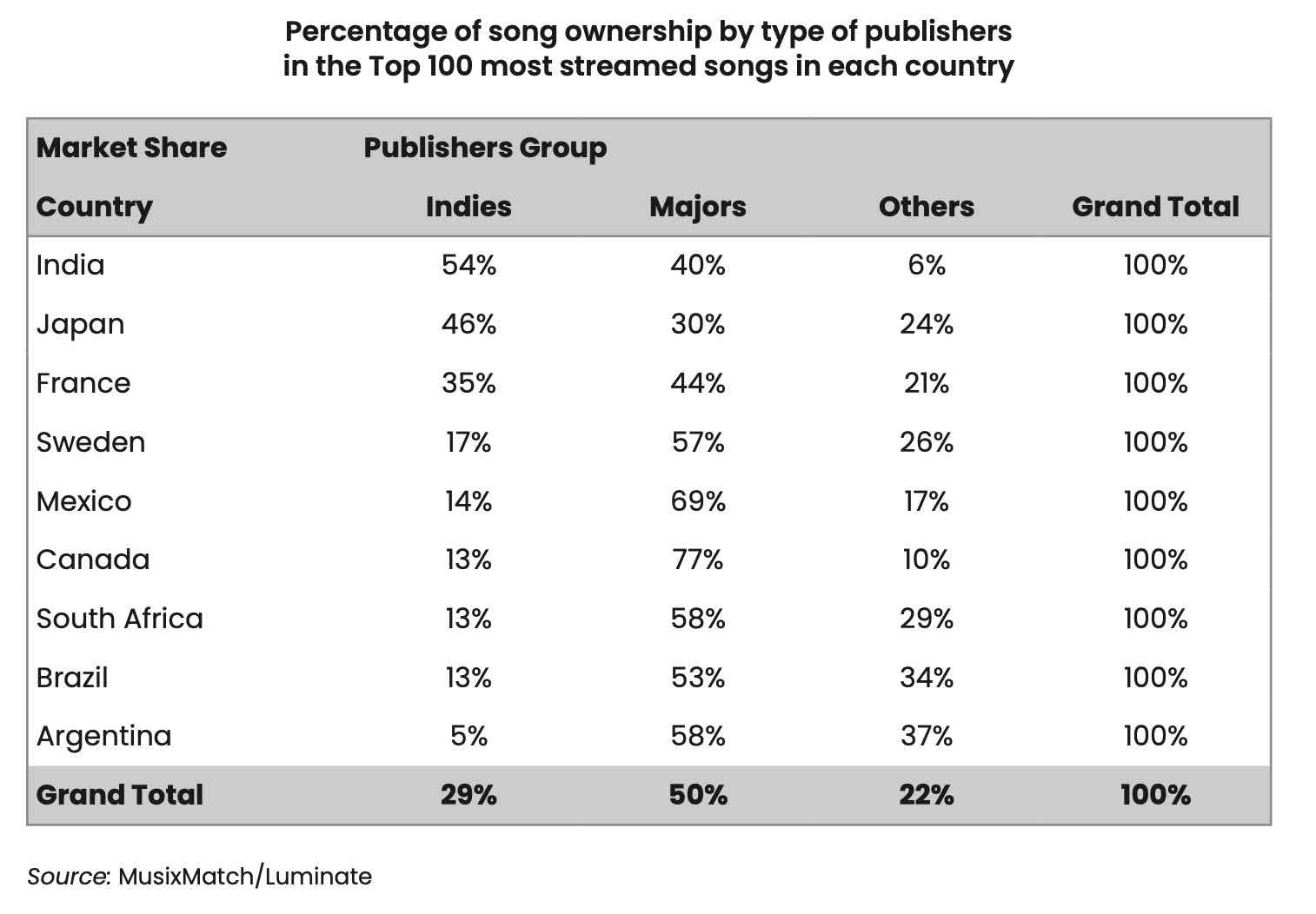

To highlight the value of indie music publishers in various markets, IMPF asked MusixMatch to provide market share by type of publishers (major or indie) for the Top 100 most streamed songs in 2021 in ten different countries, including India, Japan, France, Sweden, Mexico, Canada, South Africa, Brazil and Argentina.

The table below shows the results, including the share of non-attributed tracks, which can be defined as songs whose ownership split exceeds 100%, thus making it complicated to assign ownership, or whose publishers have not been attributed.

These results are used to illustrate the role of independent music publishers and should not be seen as a definitive market share of indie publishers in their respective countries. It is interesting to note however that the percentage share of indie publishers is 29%, not far from the global market share, with majors accounting for 50% and 20% non attributed. By the laws of probability, it is conceivable that the share of non-attributed would be split along the lines of the respective market shares of major and indie publishers.

Strong independent presence in India

The higher share of majors can be explained by their strategy to represent the works of high-end artists who generally top the streaming most played listings. The market share of indie publishers varies dramatically according to countries.

The highest share is found in India, at 54%, which is not surprising considering that major companies only recently entered this market and that most music — especially when featured in movies — is signed to local publishers.

The indie share in Japan is also very high at 46%, reflecting the very strong grip of local publishers in the country on the publishing market.

Commitment to develop local talent

Markets such as France or Sweden show strong positions for indie publishers, which illustrate the commitment by local publishers in these countries to developing local talent.

The lower-than-average share for indie publishers in Latin American countries such as Argentina, Brazil and Mexico is related to the fact that major companies have developed a presence in these markets over the past decades and have signed many top artists.

Canada suffers from the presence of its southern neighbour, which leads to the signing of many top Canadian artists and songwriters to major companies. However, a strong network of publishers is active in the English-speaking part of the country, and in the French-speaking province of Quebec, almost all artists and songwriters are signed to local independent companies.

Recovery of public performance rights

The low share of indie publishers in South Africa is more a reflection of the type of songs that were the most streamed in the country, with a strong presence of international acts.

Looking at the future, the report highlights several factors will contribute to a stronger music publishing business in the coming years, namely:

- The recovery of the public performance segment, with advertising back to pre-COVID levels;

- The live music sector back in full swing as documented by the volume of concerts taking place around the world;

- CMOs back to pre-Covid levels and enjoying growth;

- Film and TV production has resumed, and the sync business is back to pre-pandemic levels, while global video streaming services continuing to expand; and

- Favourable legislation in the United States, in particular, will see a significant increase in royalties paid to music publishers and songwriters from mechanical rights, with the creation of The MLC, and the final rate setting for the Phonorecords proceedings III and IV by the Copyright Royalty Board.

Rise of unlicensed platforms

The report also lists “a few clouds on the horizon,” including:

- The risks of a slower economy and the impact of inflation, which could affect the bottom line and the margins of music publishers;

- A slowing down of streaming adoption in the most mature markets, not yet compensated by growth in new, emerging markets;

- Adverse copyright legislation, lowering the protection of music works, or dismantling schemes such as private copying, which usually benefit the creative sector;

- The rise of unlicensed platforms, preferring to launch and operate without properly compensating rights holders; and

- AI creating “fake songs” and new copyright challenges.

Sugar Music’s Filippo Sugar

“My family has been in the publishing business for almost a century and we have seen so many things happening over the years,” explained Filippo Sugar, from Sugar Music (Italy). “Yet, one thing was a constant — there was always a need for music publishers, who looked after composers, lyricists and songwriters. What has been the bedrock of our business, throughout the years, were strong copyright laws. We tend to take it for granted but without a proper copyright system, we would not exist and we would not be able to be remunerated for the works we represent.”

Using legal loopholes

He continued: “Most importantly, we could not invest in new writers that we believe have the talent to enrich everybody’s life through their art. In the digital space, this has been even more important, since we have found ourselves in places where companies were building businesses using music but were taking shortcuts or using loopholes to avoid paying us.”

Last but not least, the report alludes to the current debate on the split of the value of digital music. The report refers to two recent studies that have focused on the music sector and the way revenues are shared. The report from the UK’s DCMS committee at the House of Commons showed that 30/34% of the price paid by subscribers goes to streaming services, and that of the remaining 70%, 55% goes to labels, 16.5% goes to artist-performers, and 15% to songwriters and music publishers.

Similarly, a report from Germany’s rights society GEMA showed that of the €9.99 paid by subscribers to streaming service, €0.45 goes to publishers compared to €4.62 to recorded music. “Various voices from the publishing industry have raised their concern regarding the split between recorded music and music publishing from what is now the main source of revenues for the industry — streaming — with a structural inequity favouring owners of sound recordings vs. music publishers,” notes the report.

A leftover from the CD era

Considering the contributions of made by music publishers to the global ecosystem, particularly their work in identifying and developing new talent, many in the industry see this as a basis to call for a “rebalancing” of the streams of revenues between recording and publishing, noted the report.

This 80-20 split between composition and recorded music is a leftover from the CD era when most of the investment in releasing music fell on the record labels, who had to incorporate the cost of physical distribution into their cost structure, noted GESAC in the report “Study on the place and role of authors and composers in the European music streaming market” (2022).

But while the split structure was relevant in the physical era, publishers and songwriters f”eel that time has come for a fairer distribution of revenue between recording and publishing,” according to the report.

Establish fair terms for songwriters

“Like every other sector of the music industry, the business of music publishers has been transformed by the advent of streaming services,” said Ender Atis, from BuddeMusic (Germany). “It has taken a while and a lot of effort, but digital revenues are starting to become significant for us and sit alongside our traditional revenue streams. However, many publishers believe that songs and compositions continue to remain undervalued in the digital licensing market, especially in comparison to recordings. It is our mission to establish fair terms for songwriters and publishers in the digital world; terms, that reflect the essential role our works play.”

BuddeMusic’s Ender Atis

IMPF said in the report that it has been advocating for changes in the music streaming payment models, with the conversation about changes to the streaming models reaching a new level with the recent inquiry in the United Kingdom, the review underway in the European Parliament, the sessions at the World Intellectual Property Organisation (WIPO), and the call by Chairman and CEO of the Universal Music Group

IMPF said it “subscribes to the need to develop a music streaming model that will share the proceeds from the revenues generated by streaming services among stakeholders in a fair and equitable way.”

The continued growth of the indie community

Aman Khullar, General Counsel at Musixmatch, concluded: “Musixmatch is proud to sponsor the third edition of IMPF’s Independent Music Publishing Global Market View. Together with our publisher partners we have worked for more than 12 years to nurture and grow the digital lyrics market — a way to earn royalties from existing rights that are now an intrinsic part of every music DSP product.”

He added: “We are particularly excited by the continued growth of the independent publisher community, and we look forward to working with our partners on growing the lyrics market and developing new products. Working with the IMPF, we know that independents have a strong and committed advocate for their rights as well as a forum to discuss and share ideas about the future of the music industry.”

The report can be downloaded in full here.