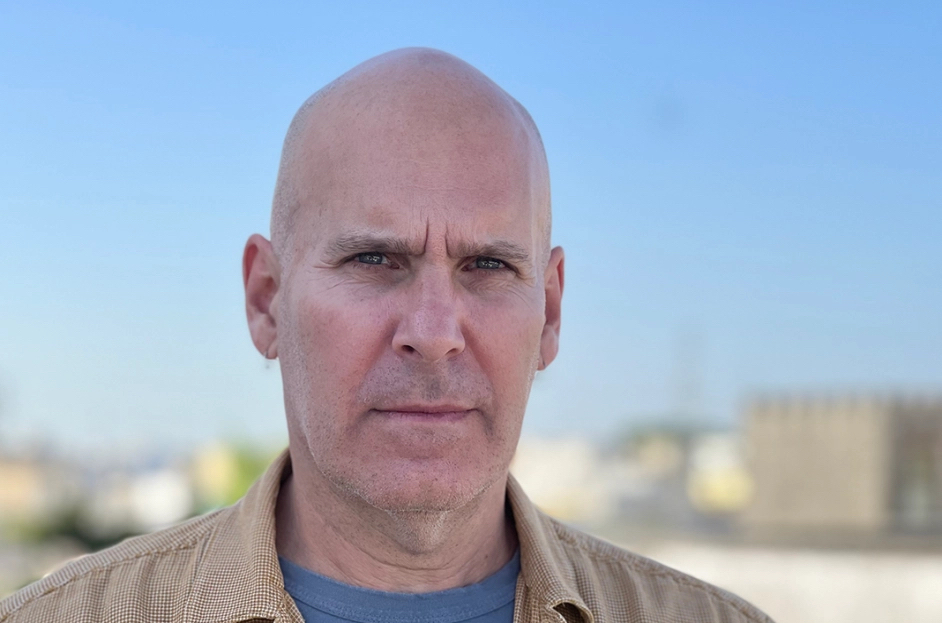

In our Money Moves series we speak to the movers and shakers of the music finance industry. Next up is Scott Cohen, CEO of JKBX.

Cohen, who co-founded The Orchard in 1997 and previously served as Warner Music Group’s Chief Innovation Officer, talks bringing music rights investment to the masses and unlocking value for rights owners and investors alike.

Where did the idea for JKBX come from?

I was speaking to a couple of catalog owners. They were looking for ways to revolutionize the music industry and we thought, shouldn’t the ones financially benefiting from music also be the fans of that music? How can we spread the wealth? That was the origin idea for JXBX and I came in as the founding CEO in October 2022.

How does it work?

First, JKBX secures the catalog by working with the rights holders to identify which song royalty shares to sell, including the percentage of each song’s total royalties that will be offered and the valuation of those shares. Once we agree on a path forward, JKBX bundles these royalty shares into what’s called a Regulation A offering and submits it to the Securities and Exchange Commission (SEC) to be approved, or “qualified.”

Once the assets are deemed qualified by the SEC, JKBX then lists those assets on its platform for customers to now be able to buy – in this case, invest in. From the customer experience, the JKBX platform will feel like investing platforms they may already be familiar with: Robinhood, Schwab, etc. The customer would sign up for an account on JKBX and can search for an artist’s name. Underneath the artist’s name would be all their songs. On Spotify, you would click play on the song you want to hear, but on JKBX, you would click “buy shares” or “invest”.

Once customers buy royalty shares of a song, they then can either choose to keep those shares or they can sell them – this action is no different, really, to how the stock market today works. If the customer holds onto their royalty shares, they’ll receive royalty revenue generated by the assets they own, distributed as dividend-like payments.

But JKBX’s model doesn’t just benefit customers/fans, with the platform, rights holders and artists/creators also benefit. Rights holders can receive proceeds from their offerings as well as a portion of JKBX earnings directed into the JKBX Rights Holders Fund. Artists/creators can receive a portion of JKBX earnings directed into the JKBX Creators Fund.

We wholeheartedly believe that every participant in the music ecosystem can and should benefit.

“We wholeheartedly believe that every participant in the music ecosystem can and should benefit.”

What is your pitch to potential investors for the platform?

In the United States alone there are 80 million people that have investment accounts. These 80 million Americans are spending $13.8bn every day, totaling somewhere near $3.5tn a year. If you look at the size of the music business, it’s somewhere between $30bn and $60bn a year.

What they’re trading is fractionalized shares of Apple and Amazon and so on. Now, with JKBX, they can expand their investment portfolio to include music assets. So our pitch to them is, you already understand buying and selling securities like Apple and Amazon, imagine if you could also do that with the songs you like or the songs that you know are valuable?

Where does the fandom element come in?

Ultimately it brings fans a lot closer to artists. It is one of the hopeful benefits of building a platform like this. The problem I’ve seen recently is that music in the background has become the primary use of music.

The background has moved to the foreground, and the foreground has moved to the background, so songs become hits but people don’t even know the name of the song or the artist, they don’t know the context around it.

I’m not saying we’re gonna go back to the old days of buying an album and reading the liner notes, but there are new ways to engage and one of them would be investing.

What’s in it for the catalog owners and artists?

Most of the meaningful copyrights in the West are actually owned by a small-ish number of people or companies. When you think about the three majors and the dozen or so private equity backed companies, there’s not that many conversations I need to have. And this is a good opportunity for them. They’ve deployed a lot of cash, now they can get some of it back a little earlier.

But I also think it’s a huge opportunity for artists. We don’t have an obligation to get their consent to list songs on the platform, but our goal is to have as many conversations as possible with the artists so that they have an opportunity to be a part of something great. It just wouldn’t feel right if we were doing it without them.

“In addition, we’ve built JKBX to be a profit share model when it comes to artists and creators.”

In addition, we’ve built JKBX to be a profit share model when it comes to artists and creators. We are holding a portion of the revenue to create The JKBX Creator’s Fund, which will pay songwriters and recording artists. And as customers invest in and trade their songs on the platform, a portion of the revenue goes straight to these creators. Again, we have no obligation to do it, but we believe it is the right thing to do.

Is there room to open this up to the independent market in the future?

It’s interesting, a lot of the publishing catalogs are independent. Some of the biggest songwriters in the world are not with the majors. With that said, as we’re going for the consumer experience, we need recognizable music in there at the start. We expect to launch with hundreds and hundreds of hit songs.

As it grows, that breadth of catalog is expected to expand. Right now, it doesn’t make sense at this stage, but there could be something down the road.

What are your biggest challenges?

One of our biggest challenges will be to bring people to the platform. I was recently reminded of this bell curve of how people adopt new products. On the far left you have your innovators and early adopters. Then you have your early majority, your late majority, and all the way to the right are the laggers.

We are not going to convince everyone on day one that JKBX is this cool, new investment platform. The early adopters are who I care about now and, I believe, the rest will come. I’ve been through this before with The Orchard – imagine in the 90s trying to explain digital music to people that didn’t even have a computer!

What have you learnt from the other companies in the space doing this?

I think there’s a number of things. One, it has to be built for the general public, for the retail investor. That’s what Bowie Bonds wasn’t.

You also have to have scale. I’ve seen a lot of people doing this with one artist, one small catalog. You have to have a big, rich consumer experience. That’s an important differentiator.

And then liquidity. We’ve already partnered with one of the largest NYSE-designated market makers in the United States. That’s been missing from all the others, including the entire NFT marketplace. Even calling it a marketplace, no offense to the people doing it, but you can buy an NFT, but good luck selling it.

“Even calling it [NFTs] a marketplace, no offense to the people doing it, but you can buy an NFT, but good luck selling it.”

As I said it also has to be put in a regulatory “wrapper” and put through the SEC and FINRA.

I haven’t seen anyone able to pull off all of those things.

Recent stats confirm the increasing deceleration of streaming growth. Where do you think the next wave of innovation and revenue is going to come from?

I think this is it – JKBX is it. There’s obviously a bit of deceleration of growth, particularly in the streaming world. But deceleration in growth doesn’t mean it’s not growing. It’s just slowing.

I look at blockchain, the Metaverse, Web3, VR and all that and I believe in all those things, but I don’t see any of that significantly impacting music revenue next year or the year after, or even in the next five years. I think it’s a long way off.

“I look at blockchain, the Metaverse, Web3, VR and all that and I believe in all those things, but I don’t see any of that significantly impacting music revenue next year or the year after, or even in the next five years. I think it’s a long way off.”

JKBX is how we unlock the value that already exists and offer it up to retail investors, to music fans all around the world. You stream their music, you go to their concerts, you buy merchandise, but what’s gonna be game changing is you now can also be an investor. What is that gonna do to your fandom?

Just how big is the opportunity here?

I do think it’s billions of dollars. We’re starting with investing in back catalog, which is quite predictable.

I think that opens up a whole other world of what’s possible, because it both unlocks the opportunity to bring in more capital into the process, but also a deeper connection with fans.

If we get this right, this will be so natural to how music is monetized and how we connect with audiences. I think this is obvious, this is the future.

It’s going to change things. It’s gonna change how artists think, it’s gonna change how fans think, it’s gonna change how rights holders think, and it’s going to change how the investment community looks at new asset classes.

“It’s going to change things. It’s gonna change how artists think, it’s gonna change how fans think, it’s gonna change how rights holders think, and it’s going to change how the investment community looks at new asset classes.”

When does the platform launch?

We’re aiming for late 2023, but our focus first and foremost is to make sure the platform has all the right pieces in place to ensure a seamless, secure, and amazing experience for the customer, the music fan, the rights holder, and the artist.

If you could own the rights to one song, either for sentimental reasons or bragging rights or purely from a financial investment perspective, what song would you pick?

Pink Floyd, “Wish You Were Here.”

Enjoyed this article? Why not check out:

- Money Moves: Iconoclast Founder Olivier Chastan on Defining the Place of Legacy Artists in the Future of Entertainment

- Money Moves: Sherrese Clarke Soares on the Enduring Value of Entertainment IP and Investment with a Conscience

- Money Moves – Merck Mercuriadis on Changing Industry Paradigms and the Future of Music as an Asset Class