As we have already started discussing in part 1, there are a lot of companies popping up in the royalty space now that the music industry is doing well once again, and there are sure to be more with bright ideas in the next few years. There are a handful of startups doing very similar things when it comes to investing, while others have a different take on the best way to make money on artists, the performance of their songs, and the streaming economy.

Check out the first part of this piece here, and read below for five more companies worth knowing about.

Vezt

Drake is one of the biggest musicians on the planet, and it seems like everything he does is streamed by millions of people the world over in no time. Everybody wants to be connected to him, and now, via this company, you can get even just a tiny cut of the royalties from one of his songs.

Vezt used one of his tracks, “Jodeci Freestyle,” as a way to grab some much-needed attention to what it is trying to do in the music industry, and it’s slowly beginning to catch on…thanks in part to the hip-hop superstar’s name being attached.

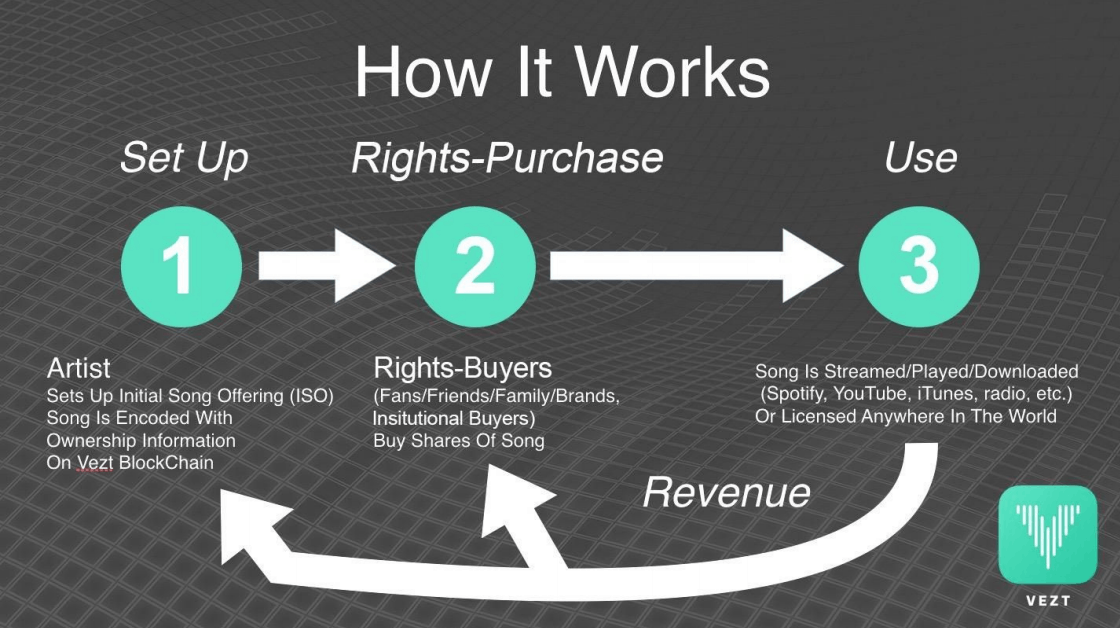

The idea is that artists can sell a portion of their future royalties to anybody interested, from fans to companies in the music space or even those who have nothing to do with the recording music world. People pay a certain, predetermined amount up front, which the musician receives immediately. With those funds, they can promote their work properly, or simply pocket the cash and move onto the next. Artists have the option of selling portions of just-released tracks or older ones, which is especially valuable these days, as streaming has made it much easier for songs that were released months, years, or even decades ago to continue to take in royalties.

Using the blockchain, which is known for being transparent when it comes to monetary processes like royalty-sharing, everybody can see what monies are coming in connected to the tune, and those are distributed properly, based on who owns what.

The company allows the buying and selling during a period known as an Initial Song Offering (or, and ISO), and if Drake’s name continues to do the heavy lifting, this could really catch on.

Fanvestory

Based in the Estonian capital city of Tallinn, Fanvestory is following suit with what a number of other companies are doing in this realm, which is allowing fans and those intrigued in this new industry forming to get involved in musician’s careers, mostly of up-and-comers at the moment.

While other startups are pushing superstars like Drake in an effort to grow (which is a tried-and-true process), Fanvestory has only partnered with lesser-known figures, with almost all of them appearing to be Estonian musical acts. The company itself claims that at least a few artists have raised just a few thousand euros for projects, and while that might not sound revolutionary, it could be career-changing for the musicians themselves. Just a few extra bucks that don’t come with tough loan or credit card payments or which don’t require the artists themselves to go out and get another job to collect can be worth the world to those looking to take their burgeoning careers to the next level.

Those investing the relatively small sums of money can feel good about what they’ve done with their funds, and perhaps even make back some cash in the process.

SongVest

After founding Royalty Exchange (which was featured on part one of this piece), CEO Sean Peace moved on and created SongVest, which isn’t too dissimilar from his first creation. Not much seems to have changed the second time around, so if you were interested in SongVest, but simply have to be involved in something newer and even more underground, SongVest might be what you’re looking for.

Purchasing shares of royalties on SongVest could be a wise business move, as the competition won’t be quite as fierce. When a title goes up for auction and many people are watching, of course the final sale price will be higher, and when it comes to royalties, that means it will be a long time before the money invested is made back. Since fewer people know about SongVest, it’s likely that auctions won’t be attended quite as heavily, and that means you have a better chance at scoring a song at a lower price, and then later, recouping your payment back faster and making a profit.

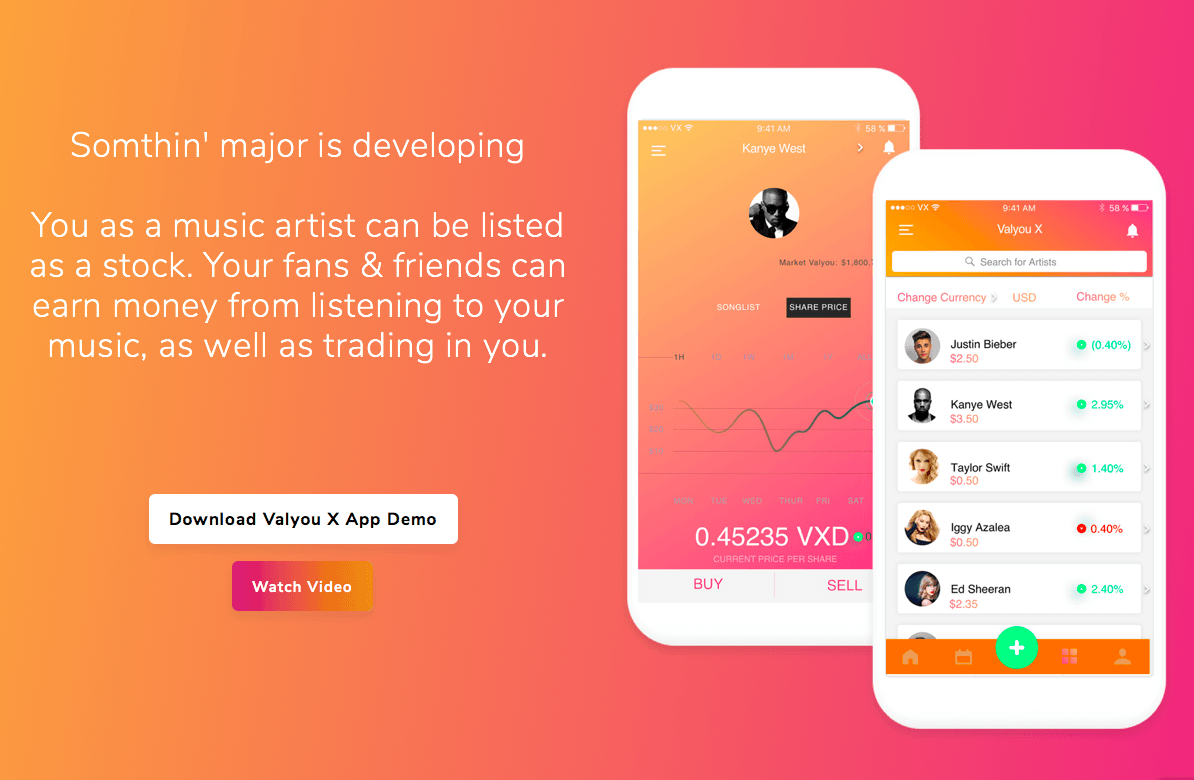

Valyou Xchange

Self-described as the “world’s first decentralised global stock market for musicians,” the oddly-titled Valyou Xchange doesn’t see an outsider investing in the artist, but rather their performance solely on this platform. Artists can sell shares, just as a company would do, only they are just shares of…well…themselves. While other items on this list see royalties being traded and revenues shared, Valyou Xchange comes off more like a game involving music and seeing who can listen to the most and trading shares like they were cards in a Pokemon game.

Of course, there’s strategy behind the whole thing, but this model doesn’t so much seem like the future of the business, so much as a fun distraction and a way for a handful artists and smart investors to make a few dollars.

SoundHouse

SoundHouse may be located in a smaller city (Boston, MA), but nothing about the company’s ambitions are tiny. The startup buys up primarily streaming royalties, but those are the ones that will be worth the most in just a few years (if they aren’t already). According to one report, SoundHouse recently spent upwards of $40 million to acquire the streaming royalties belonging to a slew of artists and thousands of songs, and that could end up returning a profit many times higher.

As an investor, there is one sentence on the company’s website that should catch your attention and get you excited: “We do one thing, and we do it with excellence.” Too many new companies try to be everything and take over the world, but that’s not possible until they have become the best at one thing. The fact that those in charge at SoundHouse know this means they are smart, humble, and likely very good at what they do.

At the moment, SoundHouse doesn’t seem interested in the average, everyday investor stepping in, but if the company does open up investment opportunities to the public, it will be massive.