It’s good news for rights holders as the social giants are finally striking deals for the use of music on their platforms. Eamonn Forde takes a look at the current status quo with the likes of Facebook, Instagram and Snapchat, and explains why the music industry should proceed with caution.

As is often the way in the music industry, a company comes along, does something new, gets some attention but is then left choking on the dust of a rival that saw what they were doing but did it bigger and better, stealing all the glory. Think of those MP3 manufacturers and download services booted into irrelevance by Apple’s double whammy of the iPod and iTunes. Or MySpace when it was steamrolled into irrelevance by Facebook. Or the many streaming services already in the market before Spotify arrived and became the industry’s new centre of gravity.

Dubsmash arrived at the end of 2014, effectively creating a new app category – social lip syncing. But running in parallel was Musical.ly, originally launched as a self-learning platform that, when it failed to gain any traction, pivoted into a teen-focused entertainment app. It quickly exploded and Dubsmash became a footnote. It started signing licensing deals in the summer of 2016 and since then Musical.ly has had something of a clear run. Until now.

The beauty of an app like Musical.ly is that it is a self-contained world. It does one thing and does it well. But that is also its biggest problem. By doing one thing, you build a tight community – but you also put a ceiling on your growth potential. The social + music space crumbled away with MySpace while Facebook steered clear of music in part because Mark Zuckerberg had been warned off it by advisor Sean Parker who had had a bad experience with the music business when he was involved in the original Napster. But Parker later got involved with Spotify. The market changes, situations change, people change, needs change.

Now Facebook is seeing music as part of its future – signing a flurry of deals with labels and publishers at Christmas, with a focus on UGC so that music can play a bigger part in its native video offering and rightsholders get paid. It was initially thought these deals were for Facebook to compete directly with YouTube (artists were holding back full videos from Facebook as native uploads as they were going unmonetised), but it appears that it was Musical.ly that Facebook had in its sights. At least to begin with.

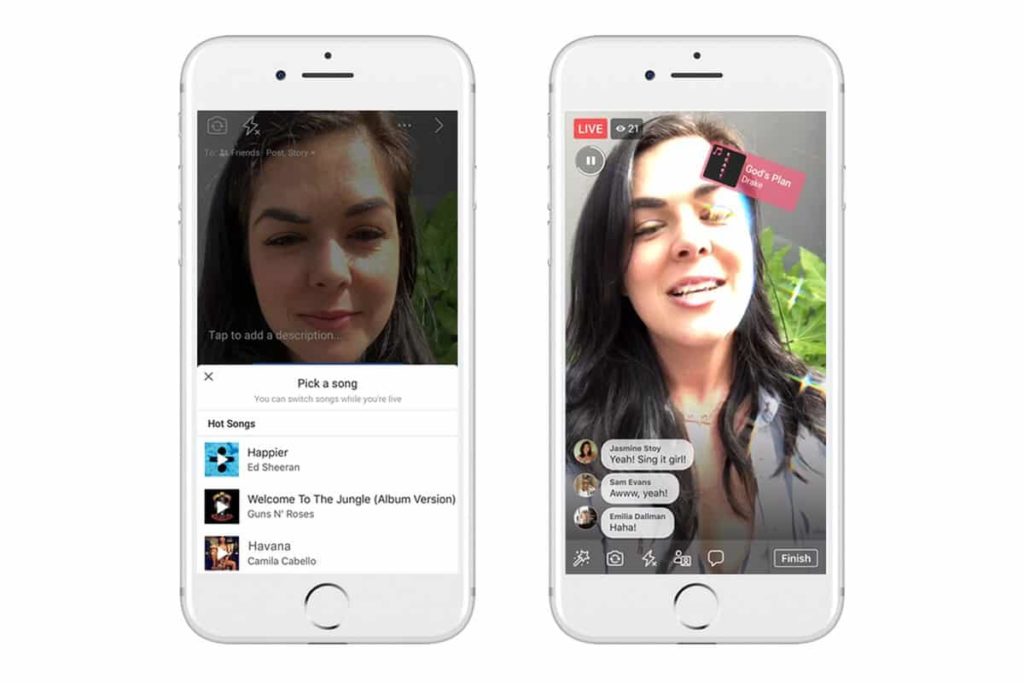

The start of June saw the arrival of Lip Sync Live – a new feature within Facebook that initially launched in a handful of markets. It might be a me-too service, but its big advantage is that it can funnel its existing 2.2bn users to try it. This is just a new feature rather than, as with Dubsmash and Musical.ly, the totality of its offering and, as such, it is not going from a standing start. And if social media and social apps are all about scale, Facebook is pushing on an open door here.

The Facebook licences also cover Instagram (which Facebook bought for $1bn in 2012) and at the end of June users were able to add cleared music to their Instagram Stories, giving it an edge over Snapchat, more of which below.

“It is no real surprise that Facebook is finally going heavy on music now. Music is a direct route to a younger audience – a demographic the social media giant is struggling to recruit.”

It is no real surprise that Facebook is finally going heavy on music now. Music is a direct route to a younger audience – a demographic the social media giant is struggling to recruit. A study in February covering the US by eMarketer spelt this out in stark terms. “This year, for the first time, less than half of US internet users aged 12 to 17 will use Facebook via any device at least once per month,” it stated. “Facebook will lose 2 million users aged 24 and younger this year […] But not all of those users are migrating to Instagram. For example, eMarketer predicts Instagram will add 1.6 million users aged 24 and younger. Snapchat, meanwhile, will add 1.9 million users in that age group. Snapchat will continue to have more users ages 12 to 24 compared with that of Instagram.”

Facebook is facing down a relevancy crisis and it is hoping that music will be the start of a bigger recovery job. It has been a long time in the planning – Facebook was recruiting for a music publishing business development manager for the EMEA region a year ago – but it is all coming to fruition now.

It is not the only social giant currently trying to regain ground and reclaim relevance via music. Snapchat almost seemed precision built for a youth audience and, more importantly, staking out a generation gap. Nothing will make young users flock to something more than their older siblings or parents expressing their utter confusion or disapproval of something.

The use of Snapchat lenses helped bring it closer to music, but a misjudged redesign at the start of this year saw it wobble just after power user Kylie Jenner said she was abandoning it, partly causing its share price to nosedive.

Bruised and bloodied, music is a big part of its fightback here. At Midem earlier in the summer, Snap Inc’s VP of partnerships Ben Schwerin gave a talk with Geffen Records president Neil Jacobsen where they flagged up the importance of music to the platform’s young userbase. It was partly a charm offensive to get the music business to back it even more, arguing the case for high engagement and why it needs to be more of a promotional partner. Then just this month it announced a deal with Pandora whereby users can share what they are listening to on the music service with friends or add to their Story feature on the social app.

The timing of all of these services moving in lockstep around music is fascinating. And it is clearly good for writers, publishers and labels that deals are being struck, advances are being paid and royalties are (hopefully) going to start rolling in.

For too long, social platforms were offering musicians and writers a means to reach an audience but, in order to do so, they had to forego royalties and find ways to monetise around the platform rather than on the platform. They offered the connections – but they did so without the headaches of licensing; but now they are bending slightly towards the music business to give them something to draw in young users and hold onto the ones they have already got.

“There is a lot to be optimistic about here as music becomes a magical ingredient for these companies. But the music industry also needs to be realistic. Just as social platforms have quickly run towards music, they can just as quickly run away.”

There is a lot to be optimistic about here as music becomes a magical ingredient for these companies. But the music industry also needs to be realistic. Just as social platforms have quickly run towards music, they can just as quickly run away. Sure there might be promises (and advances) being thrown about now – but if or when they get tired of music, what is music’s exit strategy? What does it do to mitigate against the vacuum?

It’s a fickle world, especially when you throw your entire lot in with a social media platform – just ask Zynga, the company behind Farmville.

Music might currently be flavour of the month for social platforms – but no one should presume it can never become yesterday’s news.