Introducing Music Publishing in the Age of the Songwriter, a new report from Synchtank.

Following on from our 2021 publication Drowning in Data, the report examines the fundamental shifts in the music industry in recent years and what they mean for the future of publishing, from new deal types and services that promote transparency and equality to creating more value for songwriters in the digital age.

Through interviews with leading executives and songwriters including Björn Ulvaeus, Carianne Marshall, Jon Platt, Mary Megan Peer, Merck Mercuriadis, and Nile Rodgers, the report delivers the most comprehensive analysis of the music publishing industry from the perspective of those leading it and the songwriters it serves.

This is the fourth instalment of the report, which is being released in the following four parts:

- The Evolution of Music Publishing

- Future-Proofing Publishing Services

- Economics, Transparency and Equality

- Digital Drivers of Growth

Part 4 – Digital drivers of growth

A business can only get so far on its past and it must carefully and strategically use the past to prepare for its future. That involves taking stock of existing trends and remembering lessons learned, but it also involves trying to anticipate – or at least prepare for – a future that is still unwritten.

The previous sections of this report sought to capture the past and the present of the music publishing business, pinpointing the changes (minor and major) that are shaping the sector – from new licensing models and emerging technology platforms to businesses adapting to wider societal and cultural changes (such as the push for greater inclusion and diversity as well as providing greater care and support for writers and staffers).

This is a business that has survived and thrived through forward propulsion. The closing section of the report is about what is coming over the horizon and what the business can do to ensure that its future is one of growth and expansion.

Here we zoom in on the financial and strategic opportunities for growth for both publishers and songwriters to ensure this sector retains its value – both financially and through services that publishers can offer that will ensure they are valuable partners for years and decades to come.

4.1. Music streaming and emerging markets

Despite there being some talk across not just the music streaming business but also across the media industry as a whole about an “attention recession” (essentially consumers are said to be overwhelmed with content from all sectors and start to withdraw), those interviewed for this report were confident there was still plenty of growth potential for music globally.

The most digitally advanced markets will inevitably be seeing some slowdown in growth. Streaming growth in the UK in 2021, for example, was up 5.7%, but this was coming from 22% growth in 2020. In the US in 2021, audio on-demand streaming grew 12.7% according to MRC Data, but this was compared to 17% growth in 2020.

Even so, there is still a strong belief in how much further things can go here.

MIDiA Research, for example, is forecasting that streaming will jump from 27% of publisher revenues in 2018 to almost half their revenues by 2026.

More recent numbers from the Music In The Air report from Goldman Sachs in 2022 add to this bullishness.

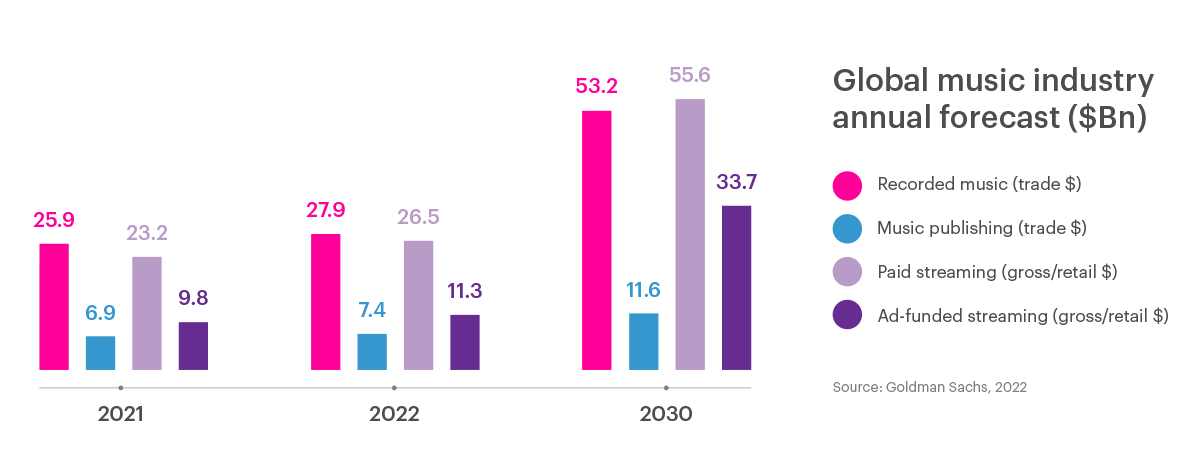

Goldman Sachs is forecasting that global trade revenues for the recorded music industry (so split between labels, distributors and artists) will top $53.2 billion by 2030. That is an increase of $7.5 billion on its previous market projection. As Music Business Worldwide noted, “It’s also more than double the size of worldwide record biz revenues last year ($25.9bn) as counted by the IFPI.”

In terms of growth for the entire music business – recorded, live and publishing – between now and 2030, Music Ally reported: “Goldman Sachs has significantly upped its prediction for 2022 from $81.6bn to $87.6bn; for 2023 from $90.7bn to $94.9bn; and for 2030 from $139.7bn to $153bn.”

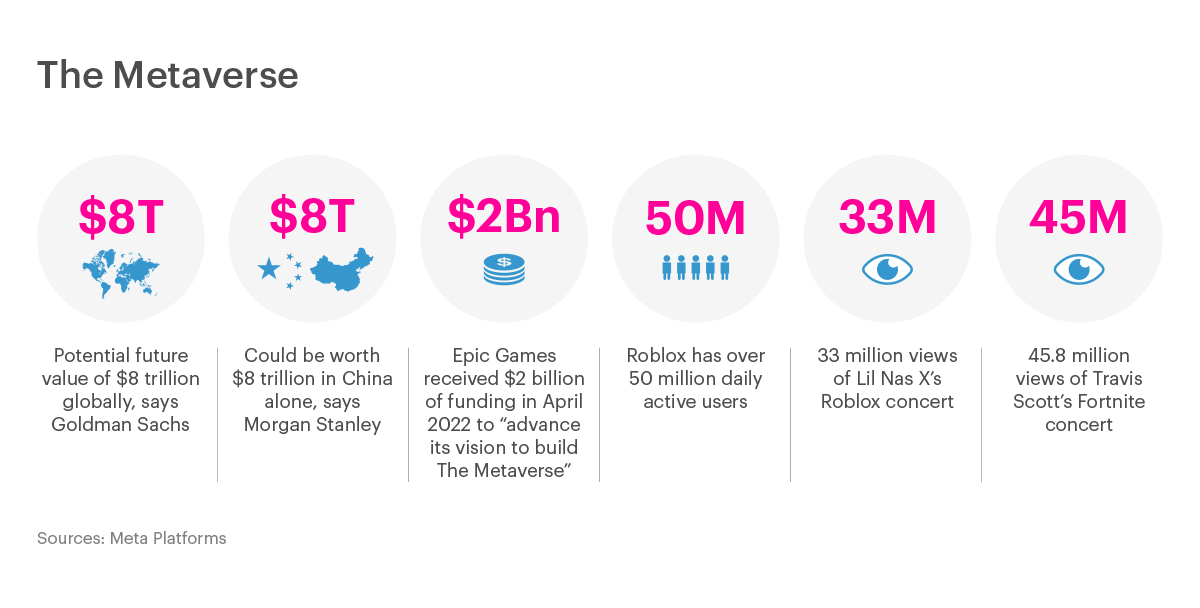

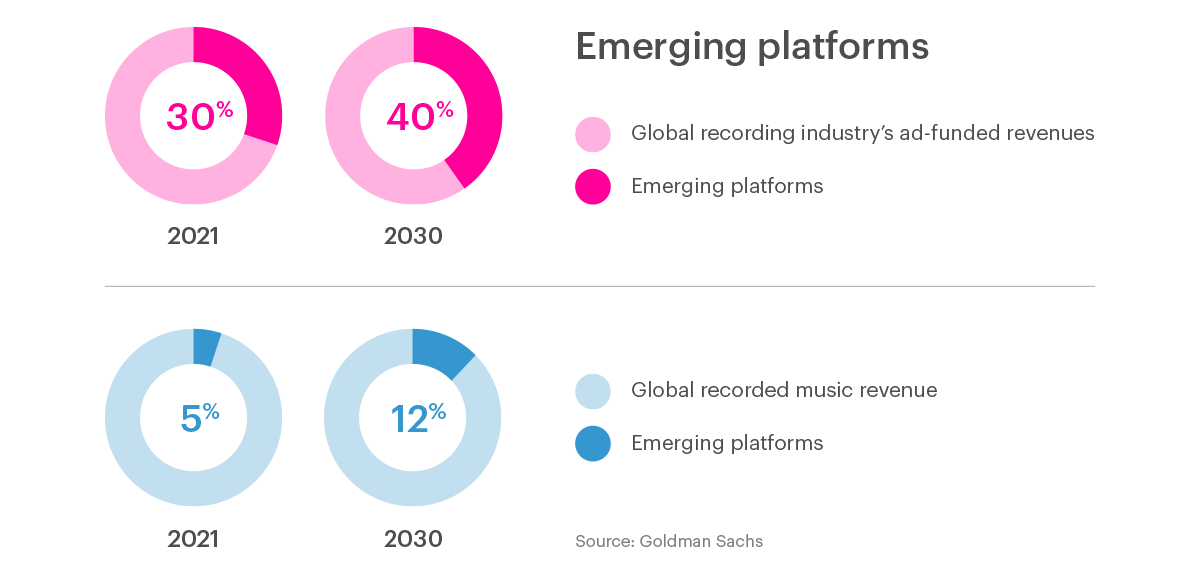

Goldman Sachs added that what it terms “emerging platforms” (i.e. “emerging” with regard to their revenue potential for rightsholders – meaning the likes of Facebook, TikTok, Snapchat, Instagram Reels, video games, and podcasts) made up 30% of the record industry’s ad -supported revenues in 2021. It forecasts this will jump to a 40% share of total ad-funded revenue for record companies (and 12% of their total revenues, up from just 5% in 2021) by 2030.

This is all sending out a clear message to the financial world that growth across the music sector is accelerating so quickly that even recent forecasts need to be updated to better articulate the anticipated boom here.

The company is confident that global music streaming revenues will reach $89.3 billion in 2030. The lion’s share will come from paid streaming ($55.6 billion) but ad-funded streaming will add $33.7 billion to the overall streaming pot.

“We expect consumer spend on music to remain resilient in a higher inflation/ weaker macro environment,” noted Goldman Sachs in the report. “We compare music streaming vs. SVOD [subscription video-on-demand] streaming in terms of pricing, penetration, churn and usage, and overall believe that music streaming should perform better than SVOD in a weaker macro environment, or potential recession.”

It adds that the streaming sector is on course to reach 1.26 billion paid subscribers by 2030 – more than doubling the 523 million the IFPI reported in 2021. Much of this boom will be down to the unlocking of the potential across a broad range of emerging markets, with Goldman Sachs saying that while such markets accounted for 38% of all subscriptions in 2018 this will grow to 60.2% by 2030.

MIDiA, in its analysis of the streaming business in emerging markets, concurs.

“Between them, Tencent Music Entertainment (TME) and NetEase Cloud Music added 35.7 million subscribers in the 12 months leading up to Q2 2021,” it wrote in early 2022. “Together, they accounted for 18% of global market shares, despite being available only in China. Yandex, in Russia, was the other big gainer, doubling its subscriber base to reach 2% of global market share. Combined, Yandex, TME and NetEase account for 20% of subscriber market share, but they drive 37% of all subscriber growth in the 12 months leading up to Q2 2021.”

Data from multiple sources bears this out.

Adam Granite, Universal Music Group‘s CEO for Africa, Middle East and Asia, confirmed that China passed $1 billion in annual recorded music trade revenue annually for the first time last year. It had over 30% growth in 2021, making it the fastest-growing of the world’s Top 10 markets. It is now number 6 in the IFPI’s top markets.

“It’s not controversial to say that China is going to at some point become the biggest economy in the world,” said Spek (founder and President of PopArabia as well as EVP of International & Emerging Markets at Reservoir) at the NY:LON Connect conference in January this year. “And when you are out bouncing around in Asia, most people will say that it’s a matter of time before China overtakes the US and becomes the biggest music market in the world.”

“There’s a lot of work to be done,” notes Willard Ahdritz, Founder and Chairman of Kobalt Music. “We do know in China, for example, that the social media business and advertising business is mostly driven by usage. How much are we getting out of this? Music creates so much value around us. How can we make sure that the music is getting fair pay from the value we create for all these people? Having said that, it is significantly better than it was in the CD environment. 90% of music in Asia was illegal bootlegs. Today we can monetize through the digital pipes.”

Mary Megan Peer, CEO of peermusic, adds that emerging markets have long been core to her company’s operations and this is reflected in it opening its first office in China in 2016 as well as buying a Korean independent publisher in 2028 to give peermusic a solid footprint in both countries.

“That’s really increased opportunities for our Western writers – and we now have a number of both European and US writers who’ve had charting hits in K-pop in both Korea and on the worldwide charts with K-pop,” she says. “Our revenue in China has grown a lot, but it is such a huge market and there’s still massive room for growth there. We’re seeing a lot of growth not only on the digital side, which everyone’s been hearing so much about, but also synchronization has been important for us in China. India and the African markets are the next in that chain of emerging markets that are getting to the point where there’s really a legitimate music publishing business there.”

Other markets and regions are bursting with growth potential.

“Latin America maintained its position as the fastest-growing region globally (15.9%) as streaming revenues grew by 30.2% and accounted for 84.1% of the region’s total revenues,” reported the IFPI. Streaming accounted for 85.9% of the market there in 2021, one of the largest proportions anywhere in the world.

For Mike Smith, Global President of Downtown Music Services, the most exciting markets and territories for him and his company are located in the Southern hemisphere – illustrated most obviously by the types of deals Downtown is doing in Africa, Central and South America, and Southeast Asia.

“We acquired Sheer, which is the biggest independent publishing company in Africa, and that’s now part of Downtown Music Services,” he says. “Through that, we’ve got a fantastic network of A&R people and sync people working in Africa.”

He continues, “We’re working very hard to combine our songwriters in Africa with our songwriters in the Northern hemisphere. So, it’s all about getting writers from Nigeria, from Ghana, from South Africa, working with songwriters in Scandinavia, in the UK, in France, in America. The same with South America. The biggest growth area in the music business right now is in Latin America. The level of talent out there is going through the roof. You know there are challenges, the performing rights organizations in Africa and South America are not as robust as they are in the Northern hemisphere, but we’re working very hard to address that.”

Meanwhile in MENA, the market grew by 35% and streaming accounted for an astonishing 95.3% of revenues in 2021.

Spek, the founder and President of PopArabia, the leading publisher in the Middle East, spoke to Synchtank in 2021 about the impact that streaming is having in not only shifting audience consumption patterns but also creating new opportunities for MENA acts to expand internationally and work with acts from the West.

“Streaming services entering new markets has taught us how consumption has changed,” he said. “Local language music has become much more important in the equation, and once markets like MENA mature over the next several years, grow subscriber numbers et cetera, I think we will see the export of artists from emerging markets penetrating developed Western markets; it’s already happening. Similarly, we will see established Western stars looking to ingratiate themselves to foreign markets through collabs with local artists, in songs that may not necessarily be in English.

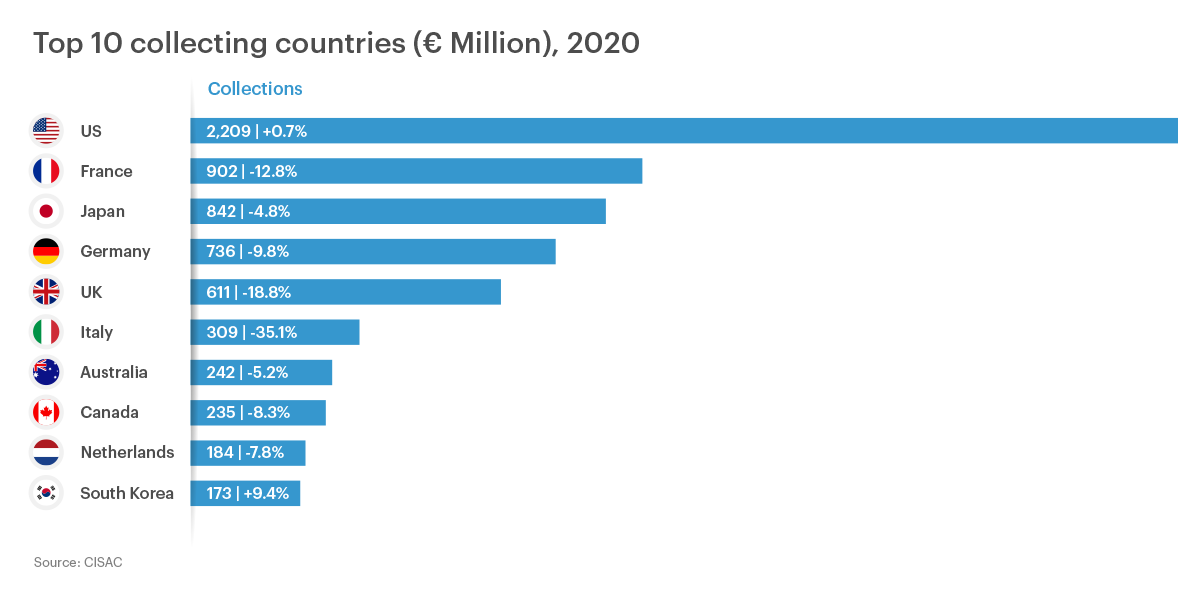

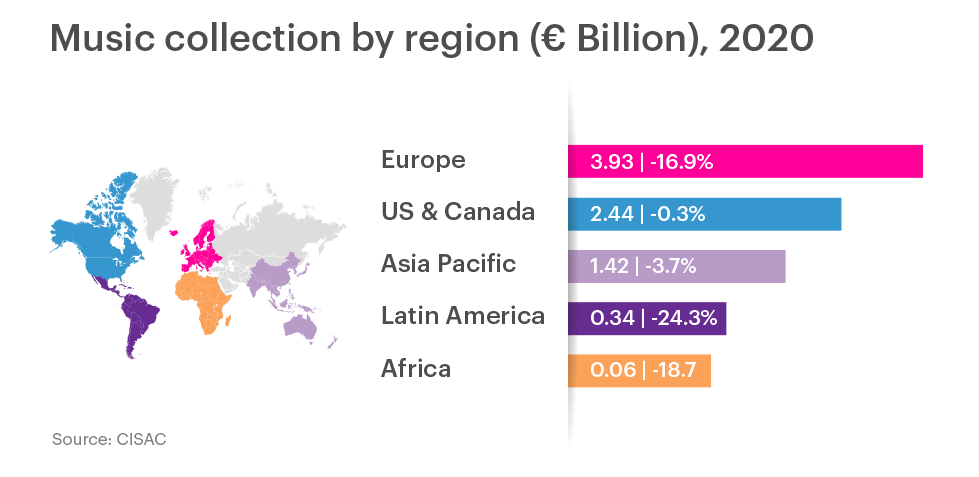

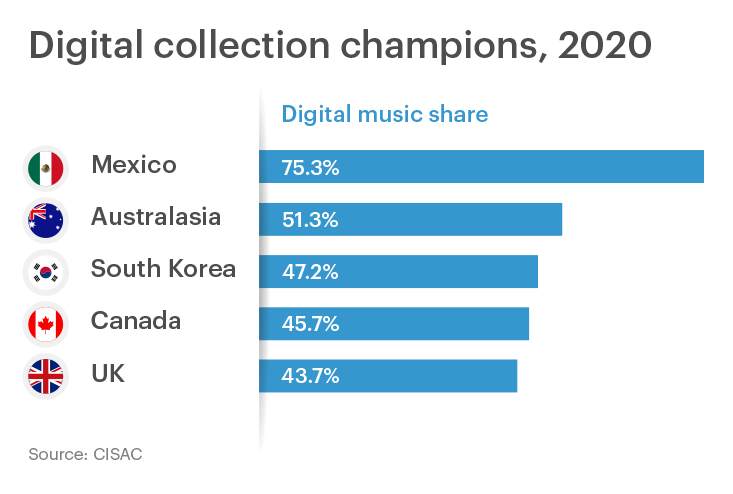

The numbers for 2021 have not been published yet, but CISAC’s Global Collections Report 2021 (based on 2020 data) shows that digital revenue helped to offset pandemic-related losses. It notes that some of the emerging territories are leading the way here – such as Mexico where digital makes up more than half of all revenue and where income grew by more than 45%.

Two decades ago, digital music was everywhere, but the problem was that the bulk of it was not being monetized. Today, the vast majority of music today is monetized (either through subscriptions or ad-supported offerings).

“What we’re losing sight of, and this is something that we should all be applauding, is that almost all consumption of music now is paid for consumption of music,” stresses Merck Mercuriadis, founder and CEO of Hipgnosis Songs Fund. “Whether you are streaming, buying vinyl, buying a CD, listening to the radio, whether you’re on Peloton, whether you’re on TikTok, almost all consumption of music is now paid consumption of music. And that’s not something that we’ve ever been able to say before in this industry.”

There are still ongoing arguments about just how much money makes its way back to creators and moves to get them a bigger share (as detailed in Part 3) and industry organizations argue that piracy has not disappeared and is becoming an issue on new platforms like Discord. Yet the fact remains that digital music is monetized at a scale that was inconceivable at the turn of the millennium.

“Streaming is amazing,” says songwriter producer and co-founder of Chic, Nile Rodgers, of the new opportunities it is creating and its globalizing power. “Now I go to countries and people know me because they hear my music on a regular basis. And I’m like, ‘I wrote that 40 years ago.’ And they’re like, ‘It’s on my playlist.’ I’m like, ‘Oh man. Cool!’ And I know that, if it’s on their playlist, somehow I’m getting paid for it. It’s a micro transaction, but I’m getting paid and there are new rules. The new rules just need to be better.”

4.2 Non-DSP streaming revenue and the “post-Spotify” economy:

There are now significantly more opportunities than ever for songwriters to take non-traditional paths into the marketplace and find new ways to have their music generate money for them.

“I believe the entire songwriting ecosystem is evolving, and it’ll no longer just be about the charts and the hits,” says Guy Moot, Co-Chair and CEO of Warner Chappell. “There’s so much quality music being made across film, TV, musical theater, and social media; and music creators are jumping at the chance to get involved. A new generation of songwriters and artists is emerging as a result, and publishers need to adapt.”

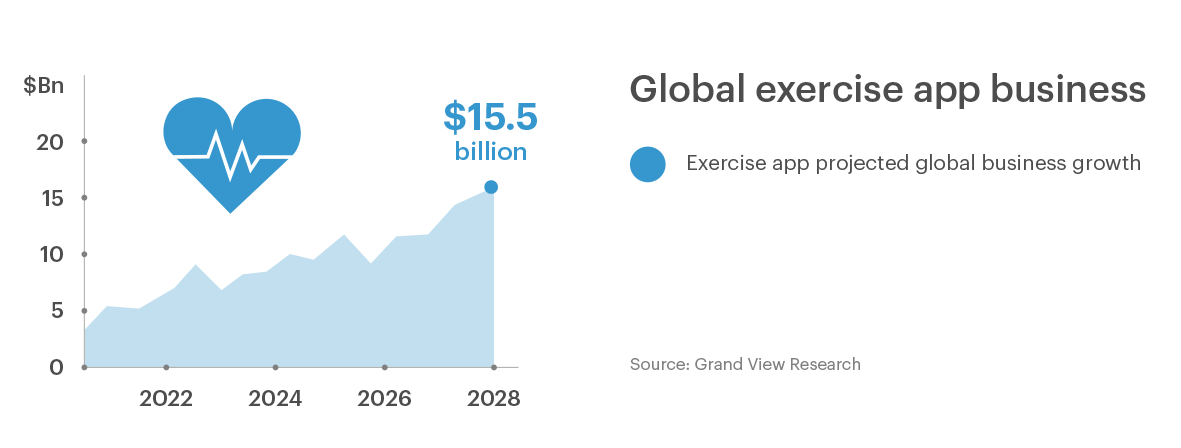

A plethora of platforms exist: from social and short-form video apps with UGC at the core (Facebook/Facebook Reels, Instagram/Instagram Stories/Instagram Reels, Snap, TikTok, Triller, YouTube Shorts), through sports and wellness (Peloton, Calm) and into gaming, sports and the metaverse (Twitch, Roblox, Fortnite), they are all placing music at the heart of what they do.

As Antony Bebawi, President of Global Digital at Sony Music Publishing, notes, “There is also a proliferation of short-form video services that have been growing at incredible rates. In almost all cases, music is absolutely central to what they’re doing.”

These are increasingly important revenue sources for the industry and major music companies are investing heavily here, signing a range of licensing deals and partnerships as well as staffing up to ensure they have the best in-house teams to fully capitalize on the growth here.

The potential here, both commercially and creatively, is enormous. Add into this podcasting as well as livestreaming of shows (which really boomed in the pandemic) and the number of places music is used and monetized is phenomenal.

Collectively these new platforms present a powerful, and growing, post-DSP economy for music and music licensing.

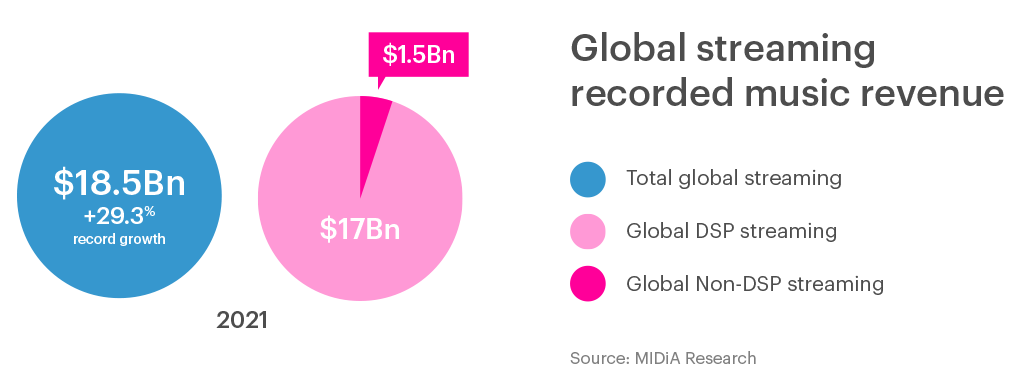

“Streaming revenues reached $18.5 billion, up by 29.3% from 2020, adding $4.2 billion – also a record increase,” noted MIDiA Research in its roundup of 2021. “One of the key drivers of streaming growth was non-DSP revenue, representing deals with the likes of Meta, TikTok, Snap, Peloton and Twitch. Non-DSP streaming recorded music revenue totaled $1.5 billion in 2021, a massive uplift from 2020. DSP streaming (Spotify, Apple Music, Amazon Music, YouTube Music, etc.) also grew strongly too, reaching $17 billion.”

Music Business Worldwide broke down Warner Music Group’s reported numbers in September 2021 and sought to put a dollar value on its “non-traditional” income streams.

“Combined, across publishing and records, this means that Warner must currently be generating around $273 million from Facebook, TikTok, Peloton etc. on an annualized basis,” it said.

Around the same time, Merck Mercuriadis of Hipgnosis claimed that TikTok alone was making up 6.5% of Sony’s revenues (this was, however, not commented on or confirmed by Sony). He did, however, make public the fact that “emerging digital platforms such as TikTok, Triller, Roblox, Peloton and others” were now contributing upwards of 15% of the revenues at Hipgnosis.

MBW had done something similar with Sony Music Entertainment’s numbers earlier in the same year. “Across the three areas of social, gaming and fitness – via partnerships with the likes of Peloton, Fortnite etc. – [Sony Chairman Rob] Stringer announced that Sony Music has generated nearly $400m during the past fiscal year.”

(At the end of May 2022, Stringer added more contextual flesh to these numbers. “New business categories, like social, gaming and fitness, account for nearly $500 million in revenue,” he said – a number that was taken to include both recorded music and music publishing income.)

One important point raised here by economist Will Page is that fitness platforms could end up benefiting publishers dealing in library music in particular.

“If a fitness company finds its music bill prohibitively expensive, library music becomes relatively more attractive, creating a lucrative runway for library platforms like Epidemic Sounds,” he suggested.

He added, “The rising tide of fitness experiences like Peloton lifted the music-copyright boat in 2021. However the balance of copyright value may favor publishers because: (i) the licensing of sync rights typically secures a 50:50 split between labels and publishers and (ii) the prominence of covers in these types of content would tip the scales toward publishers. A third factor favors publishers as well: library music. If a fitness company finds its music bill prohibitively expensive, library music becomes relatively more attractive, creating a lucrative runway for library platforms like Epidemic Sounds.”

Ensuring that this nascent music-centric fitness market was one that songwriters and publishers benefitted from has been far from straightforward or easy.

In March 2019, the National Music Publishers’ Association (NMPA) and 14 of its publisher members sued Peloton over what it claimed were more than 1,000 song infringements by the exercise company. This was raised to an alleged 1,300+ infringements by September that same year.

Peloton tried to countersue but this move was quashed by the judge in the case. By February 2020, however, the case was settled with Peloton and the NMPA/its publisher members signing a “joint collaboration agreement”.

It has proven to be a landmark event in this space and helped strengthen music publishing’s case when companies try to use music without fully licensing it.

“In-home fitness was an immaterial category until February 2020,” says Golnar Khosrowshahi, CEO and founder of Reservoir Media Management.” Obviously, it wouldn’t have accelerated the way it did, given what was going on [with the pandemic], but that’s around the same time we came to an agreement with Peloton and there was now a precedent that had been set for music licensing […] I think online gaming is going to be a huge area for licensing for music, and Roblox is leading the charge there. I think they are over 40 million daily active users, and that’s all music enabled content.”

Mary Megan Peer adds, “That highly publicized lawsuit [with Peloton] and its resolution in turn brought the rest of the burgeoning fitness industry to the table and it’s recently been reported that these companies will be spending up to $300 million a year on music licenses.”

A similar dynamic led by the NMPA saw lawsuits and subsequent partnerships with other platforms like Roblox, Twitch and Triller, with hopefully a new and more harmonious era having been ushered in with regard to licensing new services where music is a central component.

As David Israelite, President of NMPA, said (as covered in Part 1 of our series of reports) when the NMPA published its numbers for US publishing revenues in 2021, “One of the most important stories from this data is the fact that nearly 30% of the industry’s revenue sources came from places that originally claimed they did not have to license or pay songwriters.”

He added that the NMPA had exceeded $1.1 billion of legal recoveries for its members and their songwriter partners, developing partnerships with the likes of TikTok, YouTube, Twitch, Roblox, and Triller.

Then there is the expansion in synchronization opportunities (as covered in Part 2) and where things that might not have been covered by definitions of sync in the past most definitely now are.

“These post-DSP streaming revenue sources are really now the element of the business that is growing most quickly and outgrowing,” notes Mark Mulligan, Managing Director and Analyst at MIDiA Research. “So the DSP streaming market is maturing [and] and it’s these new places where music gets to which are growing faster. The way we characterize it, even if they’re not always sync deals, [is to see them as] next-generation sync.”

He adds, “If you think about sync historically as being about getting music into places where music isn’t normally central – so movie soundtracks and all the rest – it’s linear and it’s not personalized. Think about some kid playing FIFA on the Xbox. They’re listening to a soundtrack that’s been selected for them by some music supervisors; it’s not the music that they’re choosing to listen to.”

Vickie Naumann, the CEO of CrossBorderWorks, expands on this by saying that the music publishing world has long been prepared for handling and maximizing a multitude of revenue streams. As such, embracing income from both obvious and non-obvious sources today is baked into its DNA.

“I’ve always felt from the early days of digital music that publishers will be positioned for success in digital because they have such diversified revenue streams, they are accustomed to managing micro-payments, and often have their compositions in such a wide spectrum of sound recordings,” she says. ”Production and sync-ready music have increased in quality a lot over the years and for many games and immersive experiences, big hit songs can actually be a distraction for the user. I see no end in sight in opportunities.”

Chris Cass, Synchtank’s Chief Business Officer, adds, “Obviously, the world of music licensing is very different to what it was even just 36 months ago, given the emergence of significant new revenue streams from what are basically applications available at the end of consumer’s arms. We’re seeing a significant development where labels, publishers and production music libraries are looking to either deliver music from their systems to these ever-expanding, third-party endpoints in numerous digital formats, or licensing product directly to end users, be they YouTubers or others in the creative economy, or both.”

4.3 The future of music consumption and discovery

The viral impact of social media and short-form video platforms, coupled with the centrality of music on social platforms, is changing the architecture of music discovery in profound ways.

The algorithmic and editorial approaches of the DSPs will remain significant, but alongside this –

and especially for younger music fans – social media will be one of their main gateways into both new songs and catalog songs.

In Asia, we are seeing streaming platforms becoming more social in what they do and how they drive fan engagement. China in particular, with platforms like QQ and NetEase Cloud Music, is pointing the way for how things may play out in other markets.

What social media represents most for music is an entirely new way for music fans to not just discover music but also to interact with it in creative ways. The notion of passive consumption is increasingly looking archaic here as platforms like TikTok place music at the heart of assorted challenges (dances, duets, remixes and more).

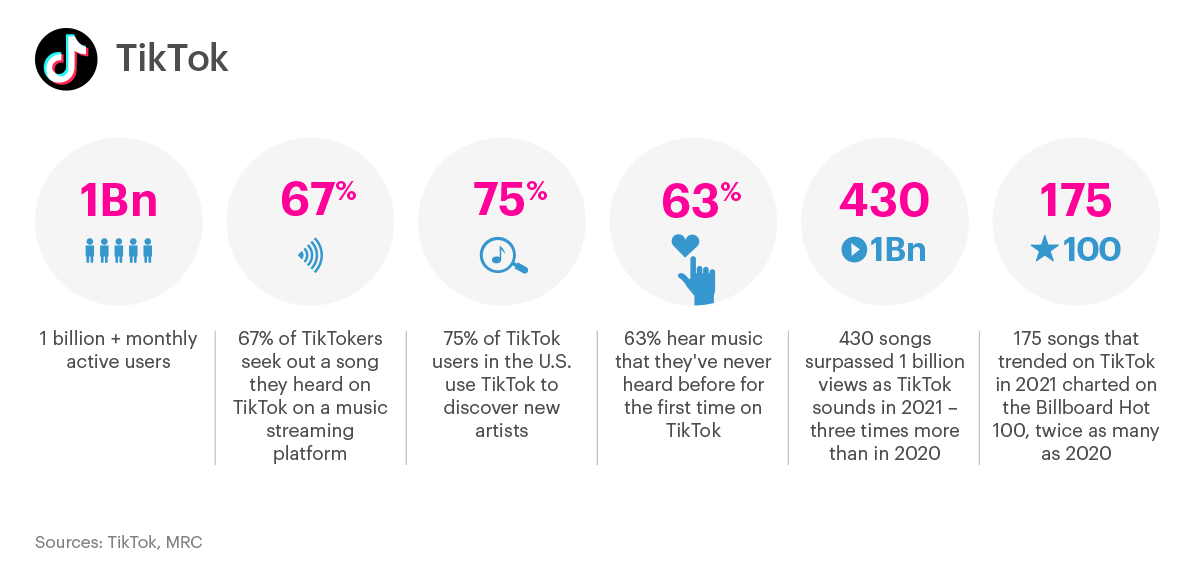

Indeed, TikTok itself claims that music on its platform is a major engine for discovery among its users. “The TikTok community is motivated to interact with the music featured in videos on TikTok,” it said in July 2021, “with 67% of TikTokers more likely to seek out a song they heard on TikTok on a music streaming platform.”

The viral impact of Fleetwood Mac’s ‘Dreams’ on TikTok is well known and the company, keen to underline its role as a key marketing platform, stated that over 430 songs each had over 1 billion video views as TikTok sound last year (a threefold increase from 2020).

“The staggering view counts on TikTok do not exist in a vacuum, but directly translate to commercial success for trending songs and artists,” it said. “Over 175 songs that trended on TikTok in 2021 charted on the Billboard Hot 100, twice as many as last year.”

It might be an outlier move for now, but the exclusive release of Kanye West’s Donda 2 album on the Stem Player is tapping into the dynamics of this creator-centric culture that is growing around music. Not every artist will want to create music with the express design that fans will twist and contort it into new shapes, but it is now a real option for them.

How we consume music has changed many times over the years, but the notion of the user as a collaborator or a creative force in their own right has never been as pronounced as it is today. The passive listener is giving way to an invigoratingly interactive future.

Adam Betts (drummer, teacher, producer, and songwriter) feels there is a huge opportunity to try things out of the ordinary and think differently in terms of spotting and pursuing opportunities.

“[It’s about] knowing what the opportunities are ahead and being able to say to the artist, ‘Look, this is already within what you make, but the way we pitch it and the way we market it could be a bit more targeted at something else,’” he says. “[It’s] just not being an agency that just connects the money, but somebody that finds opportunity.”

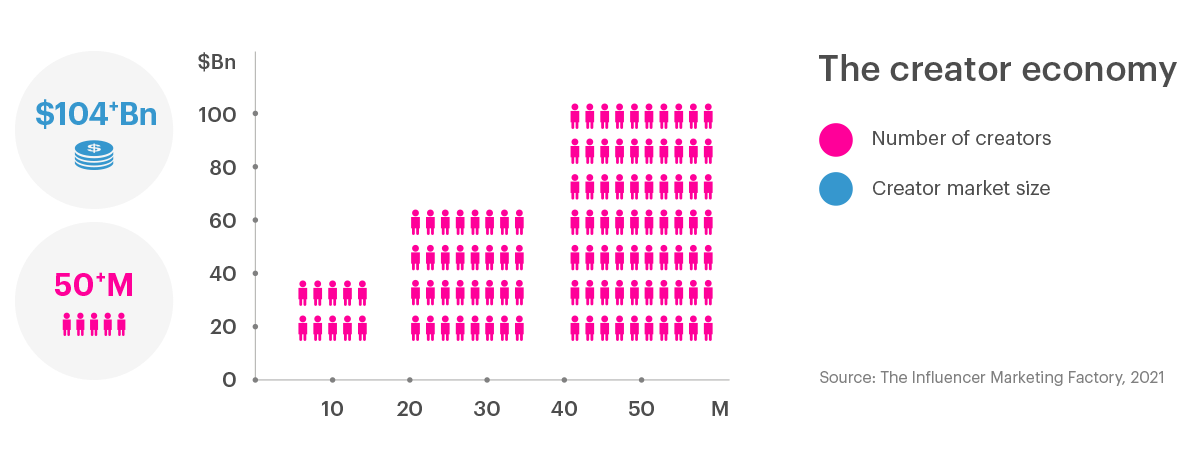

This all links into ideas about the creator economy. “The creator economy is a class of businesses built by more than 50 million content creators, curators, social media influencers, bloggers, and videographers that use software and finance tools to assist them with their growth and monetization,” explained the Influencer Marketing Factory in its Creator Economy Report. “Within a society that now seeks easy access to expertise, experiences and communities to engage with, the creator economy is built around highly motivated, creative and skilled individuals that are using digital platforms to start their own businesses, brands and communities.”

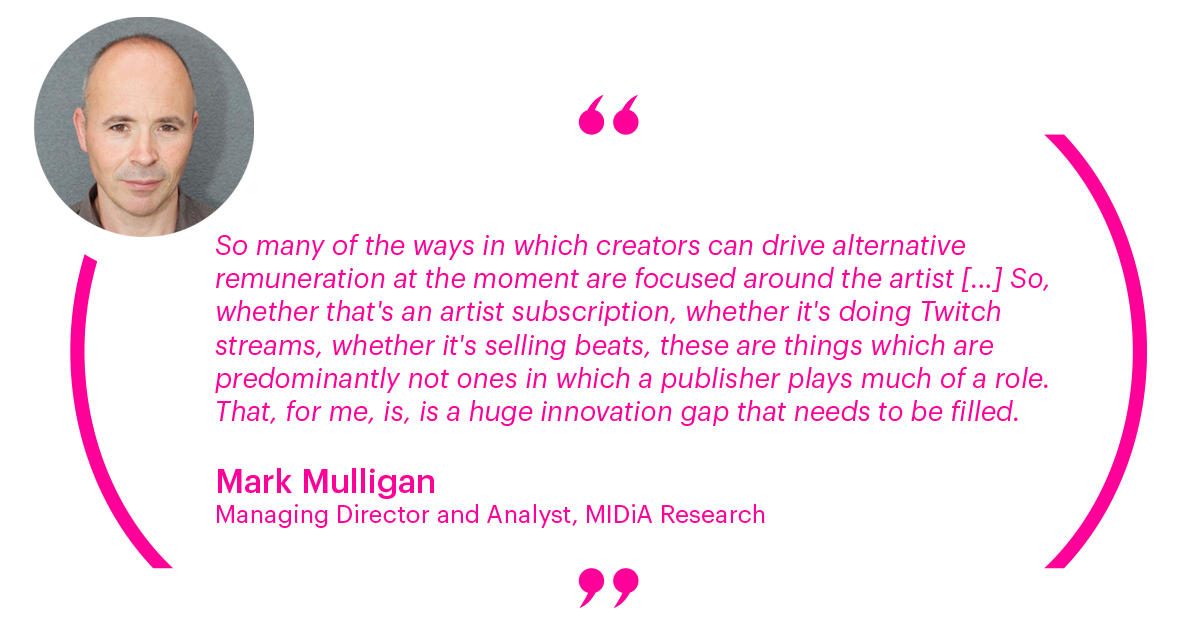

Mark Mulligan of MIDiA Research feels that the creator economy was previously too focused around the performing artist and not enough around the songwriter – but now is the time to address this imbalance.

“So many of the ways in which creators can drive alternative remuneration at the moment are focused around the artist,” he says. “We’re back to this issue about how the creator economy is focused on the artist side of it more than it is the songwriter side of it. So whether that’s an artist subscription, whether it’s doing Twitch streams, whether it’s selling beats, these are things which are predominantly not ones in which a publisher plays much of a role. That, for me, is, is a huge innovation gap that needs to be filled; but publishers need to start taking the essence of the innovation thinking that they started around song management and new interpolations and all those sorts of things and work out how we can take it in a completely different way.”

4.4 Web3 and the metaverse

The term Web3 is far from new, dating back to 2014 (back then it was called “Web 3.0”) when it was coined by Gavin Wood who had helped develop the Ethereum cryptocurrency.

“At the most basic level, Web3 refers to a decentralized online ecosystem based on the blockchain,” is how Wired summarized it. “Platforms and apps built on Web3 won’t be owned by a central gatekeeper, but rather by users, who will earn their ownership stake by helping to develop and maintain those services.”

Web3 is now taken as encompassing anything running on the blockchain and using cryptocurrency (and, of course, NFTs). It is distinct from the metaverse (which covers virtual and augmented worlds and gaming), but the two concepts are often run in parallel as they represent new rules of engagement (for businesses, for creators and for the audience) with the internet.

There is great excitement about the potential of both Web3 and the metaverse for music, with the major labels in particular investing here and recruiting staff to guide them through the opportunities and help them monetize as many parts as they can.

“Most of the exciting opportunities I see are for music in games, video platforms, and the metaverse – these are almost always music being embedded into video so these are sync license opportunities,” she says. ”These tend to be higher value deals so are great for publishers and songwriters.”

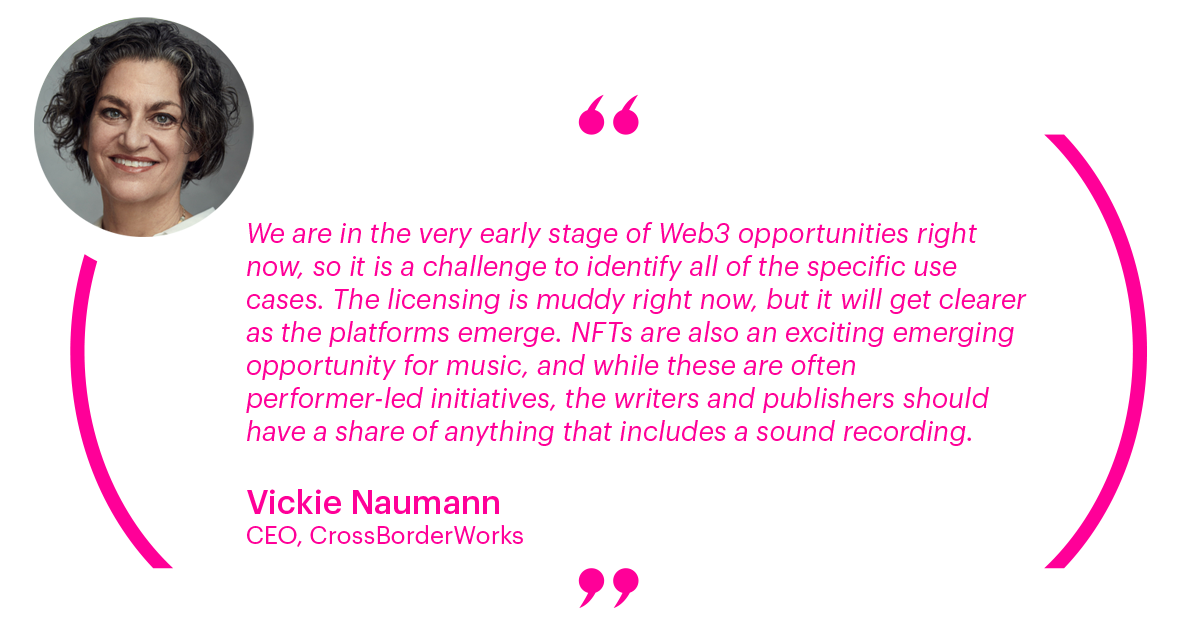

This emerging (virtual) world is not, however, a straightforward one for licensing as the ground rules are still being worked out – but steadily they will be.

“We are in the very early stage of web3 opportunities right now, so it is a challenge to identify all of the specific use cases,” argues Naumann. “The licensing is muddy right now, but it will get clearer as the platforms emerge. NFTs are also an exciting emerging opportunity for music, and while these are often performer-led initiatives, the writers and publishers should have a share of anything that includes a sound recording – either brand new and recorded for purpose or pre-existing and already commercially available.”

Within this is a growing responsibility for publishers to carefully dissect and weigh up the opportunities here (for them and their writers), ensuring that rights are properly protected and licensing systems are both put in place and adaptable to any changes in the coming years.

So much opportunity for music in these worlds goes beyond typical consumption, as illustrated by things like adaptive music and interactive music.

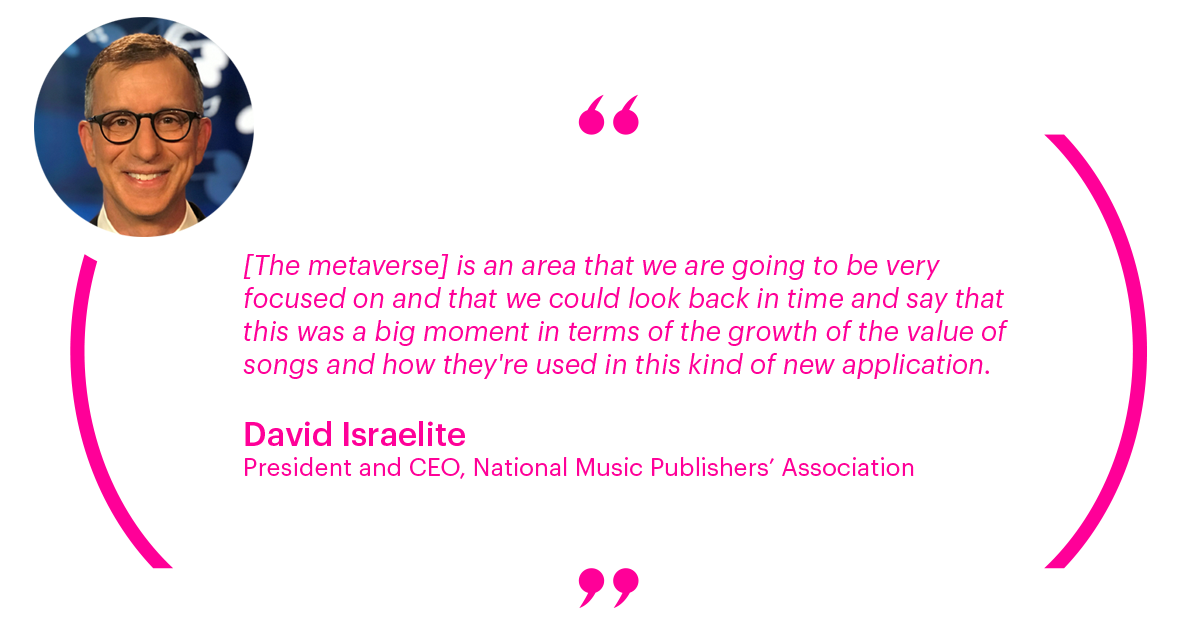

David Israelite of the NMPA says this is all an unfolding area that he and his member publishers are currently focused on.

“[It] is an area that we are going to be very focused on and that we could look back in time and say that this was a big moment in terms of the growth of the value of songs and how they’re used in this kind of new application,” he says. “I don’t know yet what the true value is of NFTs. They’re important to us. We’re focused on them long term. We’ll have to see how much value they provide there, but [they are] something we’re focused on.

Some in the industry remain hesitant about the blockchain (or are outright hostile towards it) as its evangelists tend to dangerously over-promise what it will do and how it will change things – from simplifying licensing and perfecting metadata to delivering huge sums of money to creators. There is, at times, a worrying smell of snake oil here, but that should not negate the many positive uses it can be put to.

“The basic job of a publisher is finding where the money is and collecting it on behalf of the writer,” says Tim Parry, CEO of Big Life Management. “I think if blockchain technology comes in more, that system should work. It’s sort of getting there, but it’s still a long way [away]. There’s still a lot of paper.”

Nancy Matalon, Vice President of Creative at Spirit Music Group, says NFTs are important and interesting but, in a way, prove the worth of having a publisher (or an experienced third-party company) help navigate this new terrain for songwriters.

“We’ve already done a few and it took time and resources to get the deal done because it’s fairly new to everyone,” she says of her early forays into NFTs. “So imagine if it’s a brand new songwriter who has no real knowledge of the general publishing landscape. It’s pretty complicated […] You have to be cautious about ownership of masters and publishing rights with some of the newer platforms popping up.”

John Vella, an emerging singer/songwriter and member of Tenderfoot, is generally effusive about the possibilities here and how this technology, if used right, can change things like never before.

“You can include a contract within a blockchain – so, within that code, you can have a written agreement with someone which then means that you don’t have to have any third parties anymore,” he says. “It’s just going to revolutionize every industry.”

While the rules are still being worked out, Israelite insists that the fundamentals of copyright do not change here – and nor should they.

“I think there are some people who have a misimpression that, because you might use blockchain technology, that that somehow fundamentally changes the nature of copyright law – it doesn’t,” he says. “And we’re starting to see some arguments from some players that the application of blockchain technology would mean something different in terms of obligations to license and pay for music and that will be an unacceptable approach. [It is] not that different from what Napster tried to argue, but it’s something that we’re seeing from some new companies that we’ll be battling, I think, in the near future.”

For some, NFTs mark a huge gold rush as people point to the fact that acts like Grimes, 3LAU, Steve Aoki and others can produce NFTs that generate millions of dollars. For others, NFTs are a glorified Ponzi scheme.

“People are talking about empowering us with things like NFTs and rights management on the blockchain, but it’s so theoretical and far off in the future,” says Michelle Lewis (singer, songwriter, composer, and music creators’ rights advocate as well as co-founder of SONA). “It’s like the lottery, bolstered by wishful thinking when we really should be focusing on realities of right now – the abused safe harbor laws and digital piracy and copyright infringement and the way our work is consistently undervalued by the DSPs. I’m glad there are smart people working on ways to utilize the blockchain eventually, but it’s not a panacea.”

A bonanza or a con? The truth, as is often the way, probably exists somewhere in the middle.

For some, it is something that should be experimented with rather than dismissed out of hand.

“Songwriters just need to take risks,” says Ross Golan (songwriter, record producer, playwright and host of And the Writer Is… podcast). “And if that means you write music in the metaverse, fuck it.”

There are, however, no solid ground rules for licensing here, so songwriters and publishers are moving tentatively here, awake to the possibilities but also worried about being badly burned.

“The short answer is we’ve been involved in licensing some NFTs, but it’s an area where the business model hasn’t fully settled,” says Antony Bebawi, President of Global Digital at Sony Music Publishing. “New and different variations are emerging all the time. We’re keeping a very watchful eye on what’s happening in the market. We’re working closely with our songwriters to understand where the opportunities are and to make sure that we’re protecting their interests.”

The blockchain is currently not a realistic solution for rights and royalties, and existing rights infrastructures will make dealing with these areas challenging. Therefore there is a pressing need to respond to this and find innovative solutions here.

Focusing on the purely utopian angle for a moment, however, Web3 can theoretically empower creators like never before, particularly those who retain their own rights and are nimble in how they put them to work.

The industry, however, must learn to walk here before it can run.

Molly Neuman, President of Songtrust, spoke to Creative Industries News in April 2022 about this.

“Obviously, on top of our mind is what’s happening around web3, the discussion about how to directly support creators via NFTs or other transactions using blockchain protocols or new solutions to support creativity,” she said. “However, they are not on top of our agenda because we are still trying to solve web1 problems… We are dealing with infrastructure issues, we have to engage with organizations, such as the top 10 societies in terms of music markets and how they operate. They have to decide which resources to invest in infrastructure and data excellence that will set the standard for our engagement as an industry. Some countries do not have infrastructures in place and will never have the capability to invest. So this creates a whole new range of problems in all sorts of ways.”

There are still plenty of legacy web issues that need to be resolved before everyone can dive into the waters of web3.

4.5 Licensing and technology

In an ever-changing space, music publishers have to be more adaptable to new licensing scenarios, properly assessing opportunities but also showing a willingness to experiment and be flexible.

Technology is increasingly enabling them to be more nimble here and to facilitate automated micro-licenses, subscription licenses, dynamic licensing and pricing.

These new platforms can help tap into libraries of pre-cleared music and allow music to be licensed dynamically – increasing the number of opportunities out there and dramatically speeding up the process so that these opportunities do not atrophy.

“The industry has to be flexible and it has to understand the needs of the licensees,” says David Israelite. “And historically we’ve not been very good at that. I think it’s something that we need to get better at because you want to work with these types of platforms that are providing new and exciting types of features to consumers that involve music, even if you’re not the one that was initially engaged with the type of product and lots of examples of that. We need to be flexible, but we also need to be tough and not be taken advantage of.”

Inflexible licensing infrastructures are barriers to growth and evolution, holding back the business and need to be adaptable to the times.

As such, the publishing community must work more closely with the technology community and ensure that licenses that work for both sides are put in place. Historically these platforms have used music and asked for forgiveness later. Now is the time to change this and to ensure these platforms are licensed and help grow the overall business.

“Twitter is the one outlier still, and we’ll be focused on that,” notes Israelite on this ongoing issue and how bringing them into the fold can drive significant growth. “But all of these social media companies began their engagement with, ‘We don’t need to pay songwriters.’ Roblox started with that premise. And now I think it is an enormous growth area.”

In June 2022, the NMPA announced two strategic partnerships that will assist it in its activities here in ensuring that platforms and apps that use music are approved and fully licensed. The first deal is with Songclip, a platform for licensing music in apps; and the second is with ACT, the App Association. The NMPA also sent formal notices to both Apple and Google to demand they are more rigorous in their app platform housekeeping and ensure they are not approving and hosting apps that do not infringe, or enable the infringement of, music copyrights.

This whole sector must be, argues Mary Megan Peer (CEO of peermusic), a two-way street. Publishing rights need to be respected but equally publishers need to be awake to the needs of the services looking to use this music.

“I think the services need to acknowledge that music comes with rights that need to be paid and try to seek out licenses,” she says. “But it’s important for the publishers to make themselves available for those licenses, to take the time to understand what the services offer, how that fits into existing licensing models and whether or not we need to adapt new licensing models by making sure that it makes sense for that stage of the business.”

Vickie Naumann cautions, however, that publishing rights fragmentation remains an enormous challenge for the sector as a whole and this needs to be addressed before everyone can properly move forward here.

“That’s] whether you are trying to license a handful of songs for traditional sync use or [licensing] broad catalogs and marrying up the master and publishing afterwards,” she says. ”However, this is the way artists are creating and we, as an industry, need to try to find ways to accommodate the highly collaborative music creation process as well as clear, quick and legal time to market with viable licenses.”

Creating the best framework for licensing to new media is an ongoing challenge, but this needs to be done right up front otherwise songwriters will be suffering long in the future. As streaming shows, once a precedent has been set it can be hard to recalibrate.

“It’s hard to add more fruit and less sugar to a pie that’s already baked,” argues Naumann. ”Those ingredients are not easily swapped once it comes out of the oven! So, I’m very focused on the next generation of opportunities.”

Chris Cass, Chief Business Officer at Synchtank, says this next generation of opportunities is emerging fast and that companies need to be adaptive and flexible to allow everyone in the space to grow.

“Our view is, when pausing to look at this multifaceted ecosystem that just keeps on evolving, is that it is best to occupy a space where systems are built to be interoperable, and are API-driven, so that other smart solutions can integrate with similarly smart systems,” he says. “Not one platform will rule them all. We have nearly 500 API points and actively encourage development by our customers so they can build their own unique competitive advantages to powerfully serve their clients, as this should future-proof whatever comes round the corner next, because, for sure, there will be even more waves of opportunities to license music in the future.”

The overarching opportunity within all of this to grow the pie, secure better future rates, and for music publishers to future-proof their offering to songwriters. If the sector gets this right, the revenue potential could eclipse even the most ambitious numbers currently being projected.

Key takeaways and conclusions

- As power in the industry increasingly shifts from corporations to the creator, a major shift from the ownership-led model of the past to the services-led model of the future is accelerating and will define a new era for music publishing.

- Songwriters are more empowered than even a decade ago through tech development and breakdown of global barriers, however there is still a lack of understanding of how the publishing machine works and income is generated and distributed.

- Publishers today have a number of tools, data sources, platforms, and technologies at their disposal and there is an increased opportunity to bolster and future-proof services by leveraging these.

- The biggest priority for the music publishing industry today is to ensure that songwriters receive fairer and more accurate remuneration for their work in the streaming age.

- Equally, what happens next will determine how songwriters get paid in the future. As new platforms and technologies drive the next phase of industry growth, this is a pivotal time for publishers to modernize and significantly grow the revenue pie by capitalizing on new opportunities.

- The continual arrival of new platforms does not mean that the copyright models of the past are negated, but equally there needs to be flexibility on both sides so that the next generation of technology partners can come through and open up revenue streams for all.

- Due to the increasing prevalence of distribution deals and many artists and songwriters questioning the value of a record deal today, the role of a music publisher (across both creative and administrative services) is arguably more important than ever in the current music industry ecosystem

There is a huge amount to take stock of here – and things are shifting and evolving at a faster rate than at any point in the music industry’s history. This is both exhilarating and concerning; exhilarating because the future is being mapped out in real time before our eyes; and concerning because rights still need to be protected and not crushed or compromised under the wheels of “progress”.

This series of reports is there to explain what has happened in the publishing world and what we can see happening in the coming years.

There is a constant state of flux defining the business and an emphasis on always moving forward. Progress is essential for the business to survive – just like progress is essential for the art of songwriting to survive.

Amid all the upheaval and uncertainty, the song remains the compass that helps steer the industry on its true course.

As Kobalt Music founder Willard Ahdritz says, “Being a hit songwriter today is actually a great job.”

With huge thanks to the following report contributors:

Adam Betts (Colossal Squid), Antony Bebawi (Sony Music Publishing), Björn Ulvaeus (ABBA, Session, CISAC), Brontë Jane (Third Side Music), Carianne Marshall (Warner Chappell Music), Carter Armstrong (peermusic), Chris Cass (Synchtank), Colin Young (C.C. Young & Co.), Craig Currier (peermusic), David Israelite (National Music Publishers Association), Golnar Khosrowshahi (Reservoir Media Management), Graham Davies (The Ivors Academy), Guy Moot (Warner Chappell Music), Helienne Lindvall (European Composer & Songwriter Alliance), Janet Kirker (Synchtank), Jin Jin, John Vella (Tenderfoot), Jon Platt (Sony Music Publishing), Josh Oliver (Jolé), Justin Tranter, Larry Mestel (Primary Wave Music), Lauren Faith, Lawson Higgins (The Royalty Network), Marc Cimino(Universal Music Publishing Group), Mark Mulligan (MIDiA Research), Mary Megan Peer (peermusic), Merck Mercuriadis (Hipgnosis), Michelle Arkuski (She Is The Music), Michelle Lewis (SONA), Mike Smith (Downtown Music Services), Milo Evans, Molly Neuman (Songtrust), Nancy Matalon (Spirit Music Group), Niclas Molinder(Session), Nile Rodgers, Rob Dippold (Primary Wave Music), Ross Golan, Rupert Skellett (Beggars), Sara Lord(Concord Music Publishing), Shauni Caballero (The Go 2 Agency), Stephen Duval (Empowerment IP Capital), Tayla Parx, Tiffany Red (The 100 Percenters), Tim Parry (Big Life Management), Tom Weller (Ditto), Tricky Stewart, Vickie Nauman (CrossBorderWorks), Willard Ahdritz (Kobalt Music Group)

2 comments

Your analysis of music publishing in the age of the songwriter is thorough and enlightening. Thank you for sharing valuable insights.

Informative report on music publishing trends. Synchtank’s blog offers valuable insights into the evolving landscape for songwriters.