As the news breaks that Spotify may be buying SoundCloud, Bas Grasmayer examines the wider trend of consolidation in music streaming.

Everybody’s talking about the report by the Financial Times that Spotify is in advanced talks to acquire Soundcloud. This deal, if it goes through, would bring together two companies that are both widely loved and at the receiving end of fierce criticism.

Soundcloud has been looking for an exit for a while now, and until last week it seemed the most serious acquisition candidate was Twitter, who invested $70 million in the music service earlier this year. Twitter has its own issues though, with revenue growth decelerating due to weak interest from advertisers. The company itself is also engaged in acquisition talks with the likes of Google, Microsoft, Disney, and Salesforce. So for those hoping for a MySpace renaissance and having a large-scale social network with music embedded: don’t get your hopes up.

Before discussing the implications of a Soundcloud acquisition by Spotify, I want to point out the wider trend.

For years, there was bound to be a moment of large scale consolidation in the music streaming space. This has a lot to do with the way streaming is licensed, resulting in services with very similar product offerings and price points. This year we’ve seen intensified competition between streaming services through music exclusives and discounting, resulting in Universal Music Group’s CEO reportedly restricting the practice. 2016 may go down as the year that will be known as the end of the beginning for music streaming.

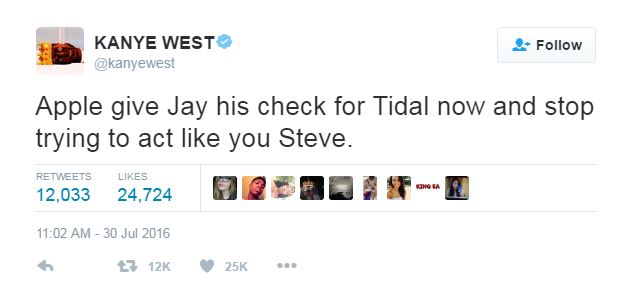

Late last year, Pandora acquired Rdio, allowing it to expand its geographic reach and product offering, launching a new $5 service and announcing an on-demand service for $10. TIDAL is also said to be up for sale, with Apple previously reported to be interested in a purchase, but industry analyst Mark Mulligan points out: “Apple is playing a waiting game. I think they’ll wait until the price is right.” They’re in a good position to do so: TIDAL saw three different CEOs in 9 months last year, laid off its CFO and COO earlier this year, and has a number of unpaid bills to settle. Acquisitions happen for various reasons, but Apple’s interest in TIDAL is not for the brand, the team, nor the technology. Apple’s interest is in getting a competitor out of the way, and with mounting debts and no prominent interested acquisition partners, it seems like Apple doesn’t have to spend money to make it go away.

A stark contrast to an Apple-TIDAL acquisition is Spotify’s purchase of The Echo Nest in 2014. The purchase was not made to get new users, nor for immediate competitive reasons, but rather to bring an amazing team into their company, together with a great set of technology now powering Spotify’s Discover Weekly, Release Radar, and the newly launched Daily Mix playlists. The company has a lot of momentum and is aiming for an IPO later this year. A Spotify IPO would be a big pay-day for major labels that hold shares in the service, as well as for a considerable portion of its staff. It will be interesting to see how that money gets reinvested.

Soundcloud has had a more difficult year, despite Twitter’s $70 million investment. After years of legal issues with the music industry, it managed to get licenses from the majors to launch a subscription service. The price point, $10, doesn’t make much sense at all. One would have expected a price point at a few bucks, but instead they decided to add the same catalogue already available on other services. It seems Soundcloud simply ran out of options and wasn’t able to negotiate something more suitable. Alexander Ljung, one of the founders, put on a brave face regardless and tried explaining the value of infusing Soundcloud’s catalogue with a bunch of dead artists. Phenomenal musicians, but people love Soundcloud because it’s where you go to access the newest releases, so it just felt out of place and an indication that this was not completely of Soundcloud’s volition.

Tech pundits labeled the subscription service ‘a mess’ and Soundcloud’s ‘latest sad death rattle’. The service’s community became unsatisfied when the service suddenly started geoblocking tracks, sometimes unbeknownst to the original artist. Then, earlier this month, it announced a decision to limit API access, now requiring an application before getting an API key which lets you power an mobile or web app with Soundcloud’s music.

As Soundcloud appears to be hitting a dead end, with usage supposedly having peaked in 2014, it’s clear why an acquisition would be great news for the company. But what’s in it for Spotify? Mark Mulligan lists two important advantages:

- A boost to Spotify’s user acquisition & conversion

- A unique catalogue, if Spotify can sort out the licensing – perhaps with the help of Dubset

The big question is, what would Spotify do with Soundcloud?

Some experts are pointing out that Soundcloud’s a great platform for Spotify to scale up its ad supported footprint. After all, $10 is not a mainstream price point, so Spotify should maximize monetization of users that won’t convert. Or could it be that Spotify’s considering a mid-tier price point? It also helps it compete with YouTube – particularly in terms of music sharing behaviour. With YouTube being open and accessible to everyone, people tend to grab a YouTube link instead of a Spotify link when sharing music to social media.

Many fear Soundcloud will be shut and turned into Spotify, but I think that’s an exaggerated fear for now. Soundcloud is a powerful brand and has a different meaning to fans and musicians than Spotify. Incorporating the user generated content and community, both valuable assets, would require a lot of work on Spotify’s side, especially if they have to build their own tools for it. One could imagine a scenario where Soundcloud stays as it is and lets artists on paid accounts opt-in to let their catalogue be used on Spotify. This is probably the most light-weight and community-friendly way for Spotify to gain a lot of original content not found elsewhere.

And it’s important they do so, because Apple Music is not done with exclusives. Increasingly so, music streaming services will have to think like labels to source original content.

As we near the year’s end, here are some things to expect:

- Resolution in TIDAL’s case, perhaps through an acquisition, some extra cash from current investors, or closure

- Soundcloud to be acquired, but by whom remains the question

- Spotify to file for IPO

We’re in for some tumultuous months.

Subscribe to our Synchtank Weekly newsletter to receive all of our blog posts via email, plus key industry news, and details of our podcast episodes and free webinars.