Looking back at the publishing business in 2019 reveals a yawning dichotomy between investors who see it as a highly valuable sector in which to put their money and publishers themselves who believe digital services and platforms are dangerously undervaluing their rights. This tension is not going away any time soon, but the to and fro here most certainly defined the year. And, underpinning all this, data remains critical and steps are being made to give writers the same level of streaming transparency that labels and recording artists enjoy.

Buy, buy, buy: the acquisition flurry quickens its pace

It is news to no one that publishing catalogues are a white-hot investment area at the moment – but taking stock of how much money was actually involved shows just how much of a bubble there is here.

Leading the pack by some distance is Hipgnosis which appeared seemingly every week in the trade press announcing a new funding round or a new acquisition. There are too many deals to list here individually but the most significant included raising £231m in new funding in October, having already raised £51.1m in August by opening up additional Ordinary Shares to investors. By November, Music Business Worldwide was suggesting the company’s total investment fund was now standing at over $850m.

This money was not idling in the Hipgnosis account, however, as it continued to buy up catalogues wherever it could. These included buying master and publisher rights in The Chainsmokers’ catalogue and the music catalogue of Benny Blanco– both in August this year. Then two months later it bought 100% of Timbaland’s production royalties across a catalogue that includes hits by megastars including Rihanna, Drake, Jay Z and Justin Timberlake.

Hot on the heels of Hipgnosis was Primary Wave with a number of purchases – and one in particular that shows how companies here are having to think outside of songwriting rights alone. In April, it did a deal with the estate of Leon Russell to take a stake in his catalogue and then in June it took a minority equity interest in Premier Music Group. In September, it bought the publishing of producer, arranger and songwriter Bob Ezrin, whose co-writes include songs made famous by Kiss and Pink Floyd. The following month it bought a stake in the publishing of Tommy Shaw of Styx.

The Primary Wave deal, however, that shows how the stakes are being raised here happened in May when it partnered with the estate of Whitney Houston to purchase a 50% stake in all her assets for a rumoured $7m. This deal covers not just her music and film royalties, but also those related to her name and likeness – meaning not just merchandise around the late star but also the “hologram” tour taking place next year. This indicates a whole new growth sector for the business and new ways for investors to link up different sets of rights. Primary might be the first to make a move like this but we can be sure that 2020 and beyond will see others follow its lead and a new style of macro investment shape the business.

Other companies were not standing back and watching this two-horse race for dominance in the independent sector: in February, ole took 100% of Parallel Music Publishing’s catalogue of over 6,500 songs; in May, Downtown Music Publishing snapped up the 10,000-song catalogue of Belgian publisher Strictly Confidential; the following month, Mojo Music & Media took a majority stake in Chelsea Music, whose catalogue includes major hits for acts like Frank Sinatra, Dean Martin and Peggy Lee; in August, Cinq Music raised $40m in Series C funding from GoDigital Media Group, its parent company, as it looks to buy up masters and publishing rights while extending its global footprint; and in September, Concord bought both Victory Records and Another Victory Publishing from its founder and CEO Tony Brummel.

None of this looks likely to slow down any time soon. Publishing is clearly of enormous value to investors (be they new entrants or established players) and this is only growing as new ways to exploit and monetise those rights come forward. And symbolising this the most is the deal Primary struck with the Whitney Houston estate. How that starts to pay out next year and beyond will shape not just its own ambitions here but also others who want to move into the broader rights business – not merely publishing rights.

Publishers at war with digital services

In the early days of streaming, many recording artists made it clear that they were not happy with the income they were starting to see trickle through. Some, like Radiohead and Taylor Swift, pulled their catalogues. But they were, for the most part, won over and their music has been available to stream again for some time. Of course, smaller acts continue to feel the pinch here, but it is the publishers who are now leading the criticisms of DSPs and demanding better remuneration. It all feels like these could just be the low rumblings before an all-out war takes hold.

There was the straight-up litigation when Eight Mile Style went for Spotify in August over alleged copyright infringement. “Spotify did not have any license to reproduce or distribute the Eight Mile Compositions, either direct, affiliate, or compulsory, but acted deceptively by pretending to have compulsory and/or other licenses,” asserted the complaint. “On information and belief, despite their not being licensed, the recordings of the Eight Mile Compositions have streamed on Spotify billions of times. Spotify has not accounted to Eight Mile or paid Eight Mile for these streams but instead remitted random payments of some sort, which only purport to account for a fraction of those streams.” It is seeking statutory damages on a total of 243 works which could, if successful, run to tens of millions of dollars.

Spotify also had to reach a settlement with Bob Gaudio and Bluewater Music Services Corporation over a mechanicals dispute that pre-dated the Music Modernization Act in the US

The company ended up taking much of the heat through the year in the appeal against the proposed 44% rate increase in the US over the next five years as proposed by the Copyright Royalty Board. It certainly objected to the increase, but so too did Google, Pandora and Amazon; yet it was Spotify’s name that landed first in the headlines about the issue – headlines that were not always cleaving tightly to the facts and which were picked up on by rivals.

Apple, which says it agrees with how the rate hike applies to its own Apple Music service, did not miss the opportunity to land blows on Spotify as the dispute escalated. “Just this week, Spotify sued music creators after a decision by the US Copyright Royalty Board required Spotify to increase its royalty payments,” it said in March. “This isn’t just wrong, it represents a real, meaningful and damaging step backwards for the music industry.”

Spotify and the others opposing the rate increase were keen to stress that they were not actually suing songwriters – but it all seemed too late to put the lid back on this as it was an accusation that was repeated unchecked in much of the media coverage of the dispute that followed.

The Swedish streaming service did itself no favours, however, by claiming that – due to its student subscription discounting and family bundles – it has actually overpaid a number of publishers in 2018. The fire already raging, this just tossed more kerosene into the flames.

While Spotify might be the biggest name in streaming, it was not the only DSP getting both barrels from publishers. Wixen Music Publishing took aim against Pandora, but this was not about unpaid or underpaid royalties. Rather it was to do with the displaying of song lyrics that Wixen claims were not covered in the lyric licensing agreements Pandora has in place. As services look to go beyond audio, this is a whole other area where they will have to tread very carefully indeed.

But perhaps the most surprising lawsuit of the year came from the world of exercise as 10 independent publishers took action in March against indoor bike company Peloton claiming it had not secured the requisite synchronisation licences for the use of music in its at-home training classes. Peloton countered this with claims of collusion and price fixing happening behind the scenes as it attempted to secure these licences. The situation accelerated in September when the National Music Publishers’ Association (NMPA) claimed more rights had been violated and was seeking $300m in damages – effectively doubling the compensation it was seeking earlier in the year when the issue exploded.

But the dispute that may dictate the publishing temperature of 2020 is with TikTok. The video-sharing app has been a key promotional platform, helping to break hits like Lil Nas X’s ‘Old Town Road’ and ‘Ride It’ by Regard; but as music becomes ever-more central to what it is offering, music publishers are sharpening their elbows to get to the front of the queue to ensure they do not end up short in terms of payouts.

As with Peloton, the NMPA was leading the assault, accusing the company of failing to secure the necessary publishing licenses to offer music on its app.

“[I]t appears that TikTok has consistently violated US copyright law and the rights of songwriters and music publishers,” said NMPA president & CEO David Israelite in a letter to Senator Marco Rubio in October after Rubio began calling on the US government to investigate TikTok’s parent company Bytedance over censorship concerns. “Many videos uploaded to TikTok incorporate musical works that have not been licensed and for which copyright owners are not being paid. While some publishers have been able to negotiate with TikTok to license their catalogs, a large part of our industry does not have agreements in place meaning numerous works continue to be used unlawfully as the platform’s popularity grows exponentially.”

Bytedance responded, “TikTok has broad licensing coverage across the music publishing industry covering many thousands of publishers and songwriters and millions of copyrights, and has paid royalties since its inception. The platform has spurred the success of artists and songwriters worldwide through its viral meme culture, driving chart hits and building household names. We are proud to engage with and support the music community.”

The fact the app has been downloaded over 1.5bn times and that Bytedance is reportedly planning a music service of its own suggests the company has very bold ambitions for music in the coming years. Publishers are obviously keen to ensure they act now and not be left with the crumbs if and when Bytedance becomes a heavyweight music platform. In many ways as far as publishers are concerned this is the same tale that has been told for the past two decades only in slightly different clothing.

A data with destiny: publishing in the age of transparency

Against the flurry of spending and litigation, a quiet debut was made that will shape the publishing world in its own way this year and beyond.

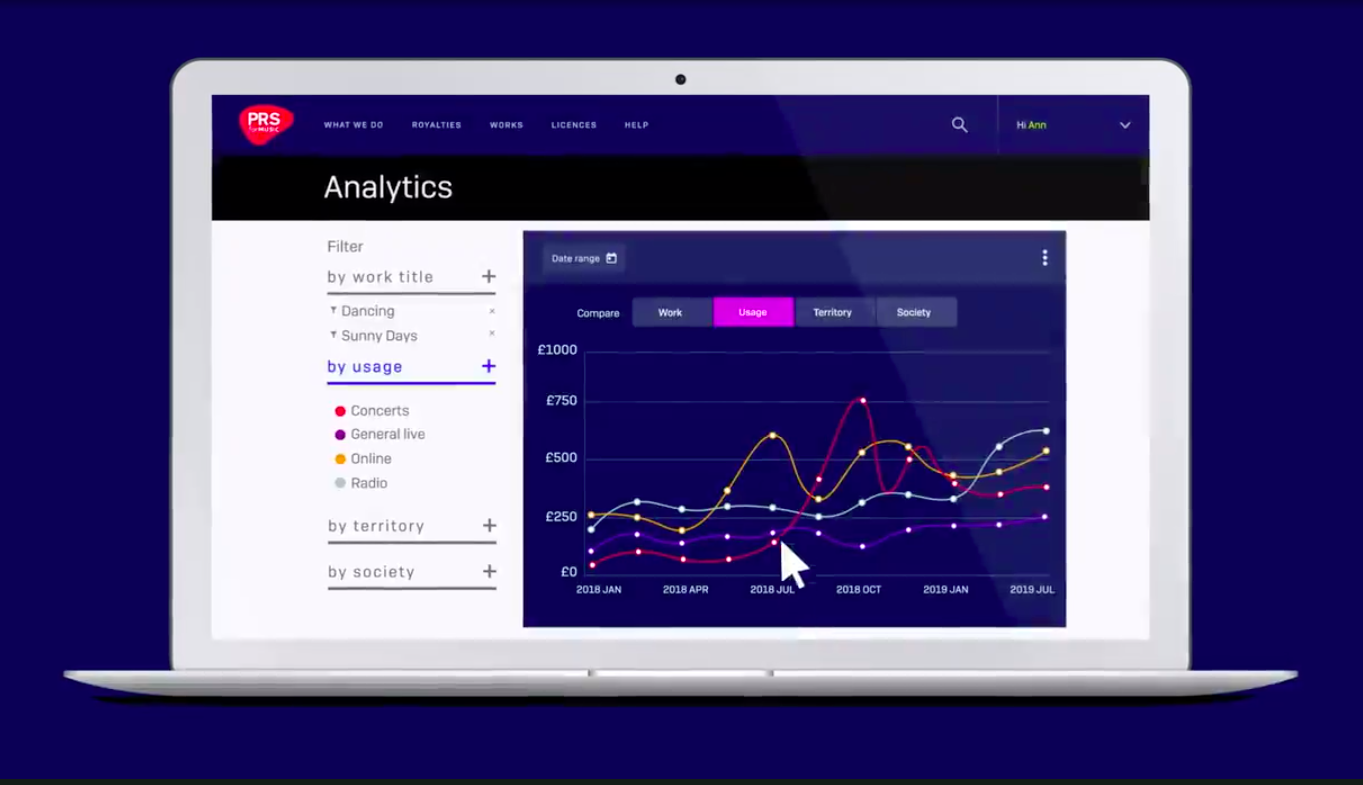

At the start of November, PRS for Music – after testing and trials with its members – opened up its new data dashboard for music creators. Unlike some of the data tools that platforms have created for recording artists and their managers (notably Spotify for Artists and Apple Music For Artists) the PRS data tools are much more encompassing and take a holistic view in regard to where it aggregates its information from.

Users can access trend analysis on their compositions registered with PRS, segmented by revenue type and territory. They will also be able to track performance/use over set time periods to see where and how certain songs are growing in use and what their peak revenue lifespan is.

Speaking to Synchtank about the launch, Tim Arber, head of member insight & policy at PRS, said that users will be able to track where their compositions are earning money across TV and radio broadcast, from live, in businesses and on digital services around the world.

“What we hear from our members is the desire for access to, and transparency around, data and information,” he said. “We’ve been very much trying to meet that need. I don’t think we’re unique in the industry in hearing that desire.”

Spotify Publishing Analytics remains in limited beta despite the company fast-tracking the launch of analytics tools for podcasters and Apple Music (and other DSPs) have still to make a move here. But it is hoped that all digital services start to open analytics tools for publishers and songwriters in 2020 as the groundswell of demand for such tools cannot and should not be ignored any longer.

======

If there was a theme that tied the year together it was “value” – not just the monetary value of catalogues but also the importance of properly valuing rights and the growing value of data. And if there is to be a priority for the industry in 2020 it must be ensuring that nothing here becomes devalued.

2 comments

So informative and insightful, thank-you for all the information, a great article.

Yeah, awesome article! Thank you for your work, Eamonn!