We chat to Matthew Smith, CEO of rights marketplace platform Royalty Exchange about how the company is revolutionising the music royalties market.

Hi Matthew, can you tell us a little bit about your background and how you got involved with Royalty Exchange?

Sure. I’ve founded a number of companies over the years, including a jobs portal in the late 90’s, an ad agency, a marketing analytics business, a real estate listings portal, and a few niche-focused publishing companies. I’ve also acquired several companies such as a domain registrar, an Irish Pub, and most recently Royalty Exchange.

My business partner Jeff Schneider discovered Royalty Exchange as an investor looking to acquire an interest in royalty streams. We learned that the original founders were raising another round, but we liked the idea so much we negotiated to acquire the assets outright. We did that in late 2015 and relaunched the platform in early 2016.

Matthew Smith, CEO, Royalty Exchange

Can you talk us through the business model of Royalty Exchange?

It’s very simple really. Our goal is to make music and other forms of intellectual property royalties easy to invest in. Royalties are one of the largest asset classes in the world without an established public market, and we aim to change that. Doing so will benefit both buyers and sellers.

Royalties are one of the largest asset classes in the world without an established public market, and we aim to change that.

Royalty deals are typically private transactions. That meant those selling royalties have little insight into how to value their catalog. And it meant private investors had no access to royalty deals. It was all insider baseball, and as a result royalties were undervalued.

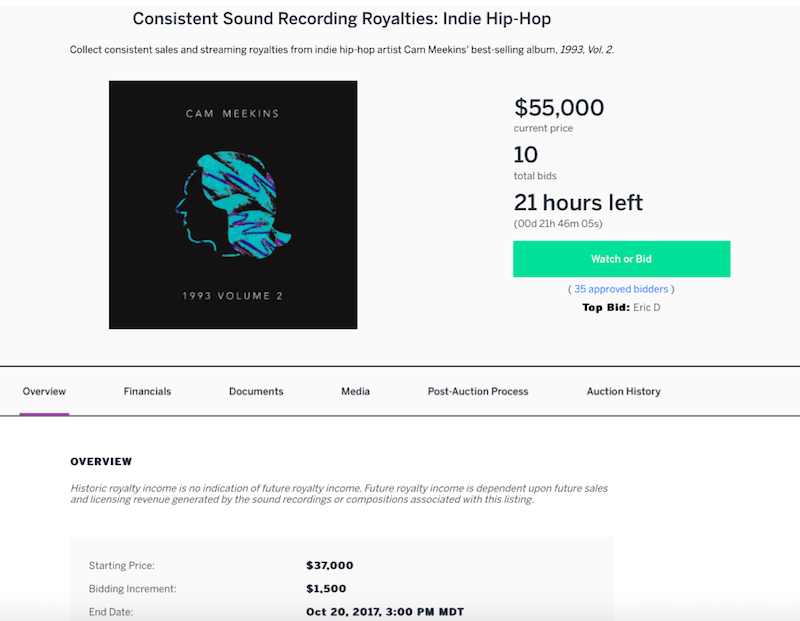

We introduce competition and transparency to the process. We connect rightsholders interested in using their royalties to raise money to private investors interested in buying them. That’s primarily done through public online auctions, where anyone can review the history of earnings, the starting price, the closing price… everything.

We don’t actually buy anything ourselves. We’re the marketplace. Our job is to ensure both sides—buyer and seller—are well represented and protected. Our value is in the health and integrity of the marketplace, and to maintain that we have to keep both buyers and sellers happy.

What rights are mainly being traded on the platform, and who’s buying them?

Today it’s mostly music royalties, but we have conducted auctions for other types of royalties like screenwriting residuals, photography, book royalties, video, and so on. As for the type of music royalties, it’s really all kinds. The majority of what we see is the songwriter’s share of public performance royalties. But we’ve also done plenty of deals involving the sound recording, traditional publishing, neighboring rights, mechanical, and so on.

Buyers are typically private investors looking to acquire passive income. They’re not interested in owning the copyright or acquiring complete catalogs the way a typical music industry buyer is. They’re not looking to “buy low and sell high.” They’re just looking for consistent, stable, passive income.

So that gives rightsholders an incredible degree of flexibility in determining what they decide to sell. We’ve put together packages as granular as 50% of the songwriter’s share of public performance with 30% of digital-only sound recording royalties.

How can songwriters tap into Royalty Exchange for new sources of revenue?

So long as they’re making at least $2,500 a year from the portion of royalties they wish to sell, we can work with them. What we offer is a way to leverage older work to pay for new projects without taking on an advance. It’s debt-free financing. So if your back catalog is only generating modest payments today, you could sell say half of it and raise enough money to fund a new album or tour, and keep 100% of those future earnings without having to recoup.

If your back catalog is only generating modest payments today, you could sell say half of it and raise enough money to fund a new album or tour, and keep 100% of those future earnings without having to recoup.

It’s really not much different than how a company sells stock to investors. That gives them a way to reinvest in their career with lump sum of capital that can have far more meaning and impact that what current royalties are bringing in today. And, it diversifies risk against those royalty payments falling in the future.

Our particular approach is flexible for the rightsholders and creates an environment where investors actively compete. This competition ensures the best possible outcome for the rightsolder.

Can you talk us through some of the most notable sales/auctions so far?

We’ve conducted around 200 auctions since we relaunched the platform, and helped artists raise over $10 million in that time. A few notable ones include the rights to a collection of Sesame Street theme songs like “Elmo’s World” and screenwriter residuals on behalf of the Tony Giess estate, who donated all his royalties to 10 different charities. Another was for a backup singer on the Wiz Khalifa track “See You Again.”

One thing to note is that we primarily work with songwriters, producers, and others who contribute to the music in a more “behind the scenes” role. Most performing artists of a certain level of celebrity can just go on tour or strike an endorsement deal when they want to raise money. But the less famous contributors who earn royalties for their work don’t have the same options.

So we’ve worked with artists who have contributed to music recorded by Barry White, Kanye West, Britney Spears, Korn, Cage the Elephant, Ella Fitzgerald, Fatboy Slim, and many more. You can review any of them on the Listing section of our site under Closed Listings.

How was the idea for Royalty Flow conceived?

We’re building a platform where rightsholders are well compensated for their royalties and billion dollars of investment capital can be deployed. The auction platform is only the first step and one pillar of this strategy. When you start looking at serving rightsholders with catalogs earning in the millions of dollars, or trying to serve professional investors and money managers, it requires “products” other than auctions to facilitate, and that’s where Royalty Flow comes into play.

How does investment work with Royalty Flow? What can investors expect to see back?

So, Royalty Flow is a subsidiary of Royalty Exchange created to acquire and hold royalty generating catalogs. The first is the producer’s share of Eminem’s 1999 – 2013 sound recording catalog. The intent is to acquire additional catalogs, which could include additional sound recording royalties, publishing royalties, and even other types of media royalties other than music.

Royalty Flow is in the process of launching an IPO, which when live will offer investors the ability to buy shares of Royalty Flow, like stock in any other company. Post-IPO, the shares will be listed on a public exchange, like the NASDAQ, where individual shares can be bought and sold daily.

The return investors can expect depends on several factors including the continued growth of streaming and the individual performance of assets acquired.

But I will say that Royalty Flow intends to issue its first dividend to shareholders within the first twelve months of trading publicly.

How are Royalty Exchange/Royalty Flow disrupting royalty investment space?

Well I’d say from the music side of it we’re really inventing the market for royalties more than disrupting it. What we’re disrupting is the traditional music finance space by not only allowing artists to take on investors in their back catalog, but offering that option to artists who don’t typically get the celebrity or recognition for their role in creating music. The idea of funding music with equity rather than debt and without owning a piece of the artist’s future work is revolutionary in the music business.

The idea of funding music with equity rather than debt and without owning a piece of the artist’s future work is revolutionary in the music business.

Given that no direct copyright ownership or exploitation is involved, surely media asset platforms helping to increase the value in publishing (such as Synchtank) will have a massive knock on effect for your business?

I think any new technology or platform that helps artists increase their earning potential is a positive step. That includes technology that better identifies and distributes royalties owed, but also platforms like Synchtank that create efficiencies in licensing so that there’s a greater pool of licensing revenue to access. It’s a very exciting time.

The music industry is reportedly at the beginning of a boom – which revenue streams do you think will see the most growth?

We’re extremely bullish on the music industry’s future. We think streaming revenue is going to fuel a bull market in the music business that could surpass what we saw during the heyday of the CD era. That will have an umbrella affect on all royalty streams. We fully support all the efforts underway to update how songwriters and others who earn royalties on the composition side are compensated. But overall we’re very excited about where things are going.

We think streaming revenue is going to fuel a bull market in the music business that could surpass what we saw during the heyday of the CD era.

What does the future hold for Royalty Exchange/Royalty Flow?

As I mentioned before, our goal is to build a platform where rightsholders are well compensated for their royalties and a billion dollars of investment capital can be deployed. Achieving that will fundamentally improve the way music and other creative work is valued in ways that I can only see as positive for the creators themselves.

We’d like to say a huge thanks to Matthew for speaking with us. Head here for more information on Royalty Exchange/Royalty Flow.